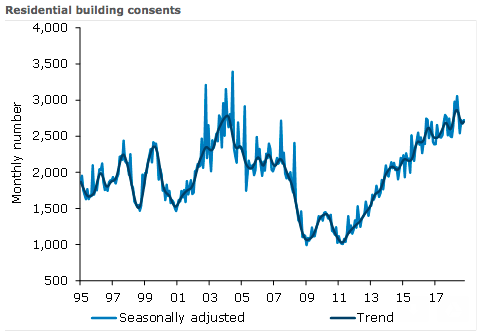

New Zealand’s residential consents increased 1.5 percent m/m in October, after finishing Q3 on the softer side. Strong growth in consented floor area bodes well for residential investment into the start of 2019.

But further growth will be needed in coming months to see activity levels maintained if not increase. Building activity is at a high level, but the construction industry is facing challenges and capacity constraints are acute.

Annual consent issuance remains very elevated; a little over 32,700 new dwelling consents were issued over the past year. However, capacity constraints are acute, and issuance has struggled to push higher over the past six months – remaining shy of highs reached in the mid-2000s (of more than 33,000 dwellings).

Generally speaking, housing demand remains strong and supportive of further building work. Population growth is still solid and has outpaced supply, while interest rates are generally low.

Nonetheless, the construction industry is facing challenges of rising costs, labour shortages and delays, which may limit the scope for activity to go higher. And although Kiwibuild will support demand in coming years, it is unlikely to boost activity significantly, due to crowding out of private sector activity in the face of capacity constraints.

Non-residential consented floor area ticked up 3 percent m/m in October, but this follows recent softening. Non-residential consents are showing tentative signs of stabilisation, which is positive in light of firms’ apparent pessimism.

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility