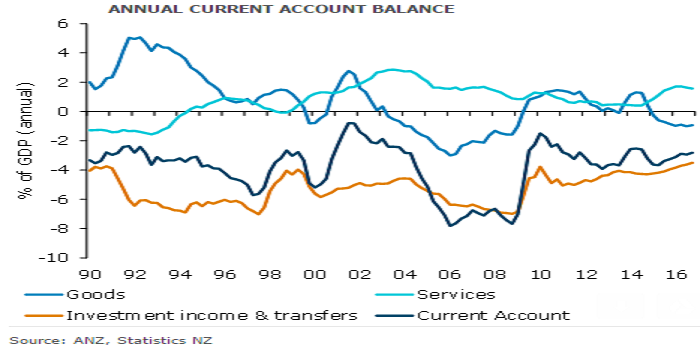

New Zealand’s current account deficit narrowed as expected in Q4, leading to the smallest annual deficit (2.7 percent of the gross domestic product) since September 2014. Looking forward, there seem to be risks skewed towards modestly larger deficits on the back of higher global interest rates and a slow closure of the domestic credit-deposit growth gap, but this is not a cause for alarm.

The unadjusted current account deficit narrowed to USD2.3 billion in Q4 (from USD5.0 billion), broadly in line with consensus expectations. In annual terms, the deficit narrowed to 2.7 percent of GDP, which is the smallest deficit since September 2014 and well below its historical average of 3.7 percent.

In seasonally adjusted terms, the current account deficit also narrowed (by slightly more than we expected), printing at USD1.6 billion, down USD0.4 billion from Q3, driven by a further increase in the services surplus to an all-time high of USD1.2bn on increased international tourist spending, offset by a mildly larger goods deficit. The income deficit also narrowed by around USD0.4 billion to USD2.0 billion as income from New Zealand’s offshore investments increased in the quarter.

Further, net external debt of deposit-taking institutions rose a touch in the quarter to just over USD105 billion. However, that was offset by reduced external borrowing from the central government and 'other' sectors, meaning that the county’s total net external debt position actually fell to USD143.5 billion or 55.0 percent of GDP, the lowest since 2003.

"Nevertheless, even if we do see some deterioration in our external imbalances from here, the starting point is good (by New Zealand standards at least) and that needs to be borne in mind when assessing things like NZD valuation," ANZ Research commented in its latest research report.

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility