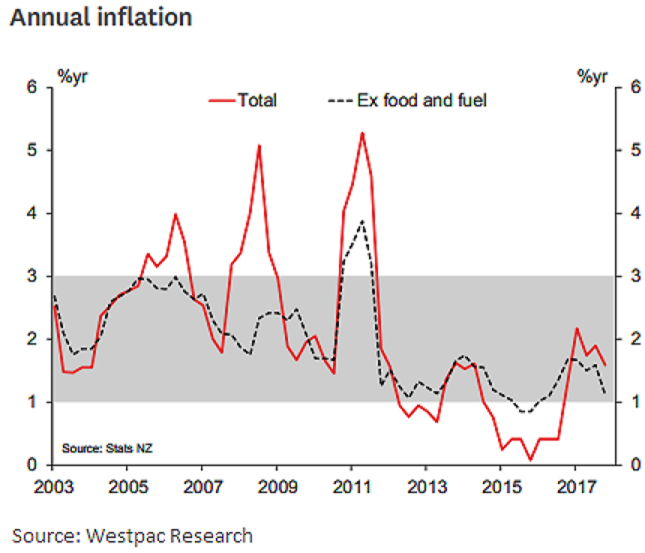

New Zealand’s consumer price inflation is expected to remain in the lower half of the Reserve Bank of New Zealand’s (RBNZ) target range over this year, implying no urgency to raise interest rates, according to a recent report from Westpac Research.

Inflation was more subdued than expected at the end of 2017, largely reflecting a lack of price pressures for internationally-traded goods. The Consumer Price Index rose by 0.1 percent in the December quarter, bringing the annual inflation rate down from 1.9 percent to 1.6 percent.

Today’s result reinforces the view that the need for OCR hikes is a long way off. Despite an improving global economy, inflation – particularly in terms of the manufactured goods that New Zealand imports – remains largely absent. Meanwhile, domestic inflation has picked up from its lows but is still well below pre-financial crisis levels.

"We expect annual inflation to remain below 2 percent over the course of 2018 as well. The economy is expected to continue growing, but at a modest pace that is unlikely to put it at risk of overheating. The global economy is improving, but the weakness of global inflation suggests that some spare capacity remains. In such an environment, it is hard to see the Reserve Bank coming under pressure to lift the OCR," the report added.

Lastly, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality