New Zealand firms' outlook about both their own prospects and that of the wider economy improved in September. According to the ANZ Business Outlook, net 27.9 percent of firms were optimistic about the general economic outlook over the coming year, up from a net 15.5 percent in August. A net 42.4 percent of companies see their own activity expanding, compared to a net 33.7 percent a month earlier.

A net 34.4 percent expected increased profits compared to a net 22.2 percent in August, while a net 25.3 percent are expecting to hire more staff in the year ahead, up from 19.2 percent a month earlier.

Confidence improved across all of the sub-sectors, with service sector firms remaining the front-runner. Agriculture saw a decent bounce (most notably in general business confidence and profit expectations) but it didn’t jump the most across the board. That shows there is more to the survey’s lift than simply improving dairy prices.

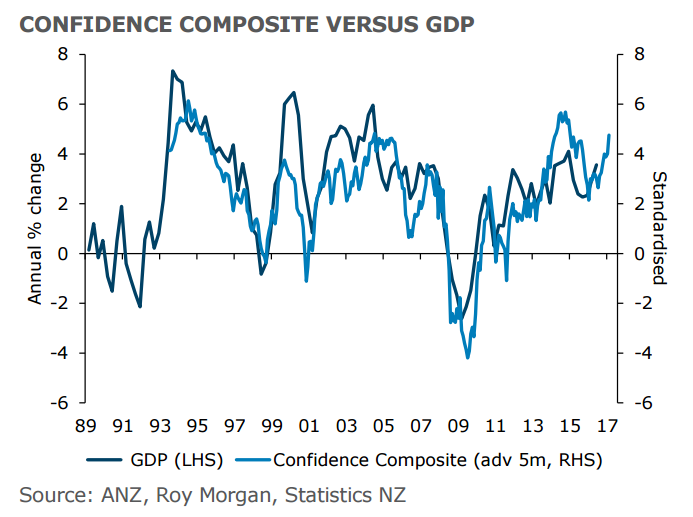

"The economy remains odds-on to put in another good year," ANZ Bank New Zealand chief economist Cameron Bagrie said in his report. "Our confidence composite indicator – which combines both business and consumer sentiment – is pointing to GDP growth accelerating from its current pace of 3.5 percent. The New Zealand economy remains a furlong out in front of most developed-nation peers." he added.

The Reserve Bank of New Zealand watches inflation expectations closely as the nation grapples with a strong currency, making it difficult for price stability target. Despite the confidence boost, pricing intentions barely shifted at a net 16.8 percent from a net 14.9 percent. Inflation expectations for the coming year held steady at 1.44 percent.

Craig Ebert, Senior Economist at BNZ, suggests that the New Zealand’s business outlook is getting too strong for the Reserve Bank to credibly downplay. The RBNZ kept rates on hold at a record low of 2.0 percent last week but said that further easing would be needed. Wheeler reiterated on Thursday that "a key rationale for cutting the official cash rate has been to lower the risk of a further decline in inflation expectations."

NZD/USD was trading 0.26 percent higher on the day. The major holds major trendline support at 0.7228, break below to target 0.7175. Momentum studies are neutral for now. Major support level - 0.7228 (trendline), while major resistance level - 0.7294 (23.6% Fib).

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination