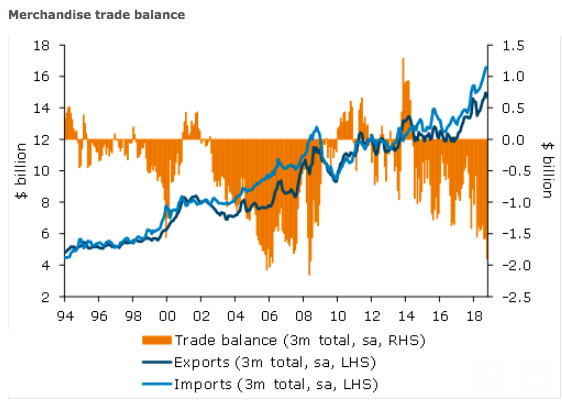

New Zealand’s monthly goods deficit was the third largest on record when excluding large items (aircraft), surpassed only by the previous two months. The annual deficit is now the highest in 11 years.

Imports reached their highest level ever of USD6.2 billion in October, mainly due to petroleum products. Exports also rose strongly as fruit (in particular kiwifruit), meat and forestry products all continued recent strength.

The unadjusted monthly trade deficit pared back USD300 million in October to USD1,295 million. Both exports and imports were slightly higher than expected; petroleum products accounted for a third of the rise in imports. Cell phones and mechanical machinery and equipment also contributed strongly.

On a seasonally adjusted basis, exports fell 6.4 percent m/m, but are hovering around historically high levels. Surprisingly, fruit exports were down 0.9 percent m/m, despite the USD165 million in total kiwifruit exports being the highest on record for an October month. Dairy, meat and forestry products all rose on strong volumes (6 percent, 13 percent and 12 percent respectively).

Seasonally adjusted imports fell 4.6 percent m/m, partially unwinding last month’s revised 9.6 percent lift. Petroleum products fell 15 percent m/m in what typically is volatile data, but major imports such as mechanical and electrical machinery and equipment (cell phones) rose 20 percent and 6 percent apiece. Textiles also rose a solid 18 percent m/m. Overall, imports items came in on the high side and paint a picture of solid domestic demand.

On a regional basis, China continues to command a higher share of New Zealand exports. Exports to China in the past 12 months were $13.5 billion, representing 24 percent of all goods exports. This includes large chunks of New Zealand’s major export groups such as dairy, forestry, meat and fruit exports. By contrast, exports to Australia are just 16 percent of total goods exports.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility