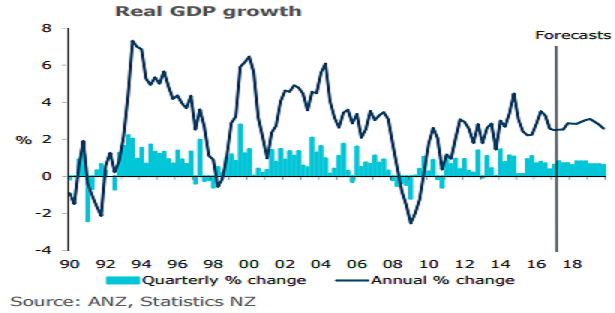

New Zealand’s GDP growth is expected to hold in a 2-1/2 to 3 percent range going forward over the near term. A necessary turn in the housing cycle to curb financial stability risks, weak productivity growth and capacity constraints cap the upside. At the same time, the drivers of the economic expansion are evolving, ANZ Research reported.

However, the economy is grappling with some material growth headwinds, many of them unsurprising given the economy is in its eighth year of expansion. Financial stability considerations have necessitated a turn in some pro-cyclical pockets of the economy.

Further, the combination of LVR restrictions, restrained credit, a turn in the interest rate cycle, stretched affordability and reduced interest from offshore buyers has slowed housing market momentum, especially in Auckland.

Also. The growth in international tourist arrivals is slowing. The sector’s recent performance has been strong, in part due to recent sporting events. However, the rate of underlying growth had starting slowing ahead of this, and we suspect that that reflects capacity issues more than anything.

"We see inflation creeping higher, but only gradually; Non-tradable inflation is forecast to hold around its current 2-1/2 percent level for a while longer, before inching up towards 3 percent by the middle of 2019. Tradable inflation will be thrown around by moves in oil prices and the NZD, but ultimately is expected to average only a little above zero," the report said.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data