The National Bank of Poland’s (NBP) monetary policy committee (MPC) still sees stable rates as the most likely scenario in the recently released minutes of the latest monetary policy meeting. This is despite the fact that the economic growth will likely be somehow slower than had originally been anticipated.

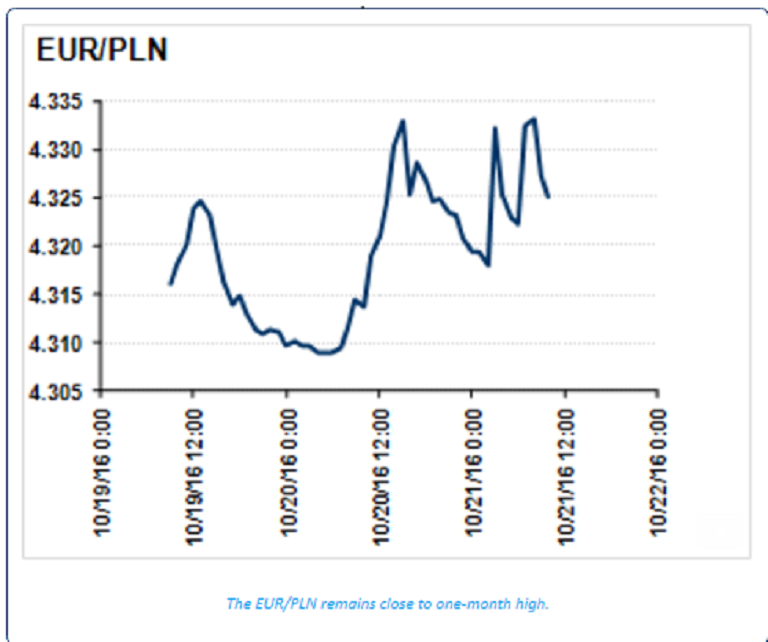

The stability of the Polish official rates in 2017 remains the base case scenario as well. Still, the zloty weakened against the euro by about 0.5 percent during the day. In the meantime, the Czech koruna remains glued to the Czech National Bank’s (CNB) intervention floor (EUR/CZK 27.0) while EUR/CZK forwards have fallen considerably over the past few weeks as markets prepare on the exit from interventions.

From the point of view of the timing of the exit, yesterday’s meeting of the European Central Bank (ECB) did not bring substantially new information. It is, however, important to keep in mind that the CNB is currently preparing its new economic projection that will be released on November 3 in which the CNB assumes the ECB will terminate its QE programme at the end of March (with no tapering).

Therefore, should the ECB eventually (i.e. at December’s meeting) extend the QE (which cannot be ruled out), this would mean that the exit may also be postponed towards the end of next year, KBC Central European Daily reported.

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns