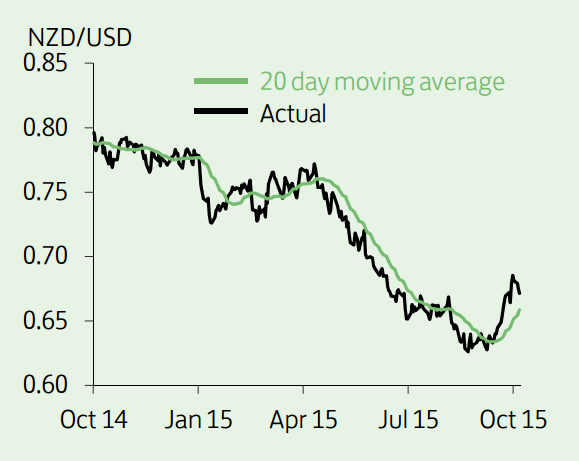

The New Zealand dollar has been the best-performing G10 currency over the last month. Market expectations of another 25 bps interest rate cut from the central bank- the fourth consecutive cut and possibly the last - have been pushed out. Milk prices, a key export for New Zealand, have also risen, albeit from a low base. This should provide further help for the New Zealand dollar.

Even if the central bank continues to cut interest rates, a break below 0.60 against the USD would unlikely be sustained on a technical and fundamental basis. However, a retracement of recent gains in the short-term cannot be ruled out given the central bank still has room to cut its policy rate from 2.75% - a relatively high level by developed market standards. The exchange rate is expected to stabilize around the 0.65 level.

NZD/USD Outlook

Wednesday, October 21, 2015 10:51 PM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX