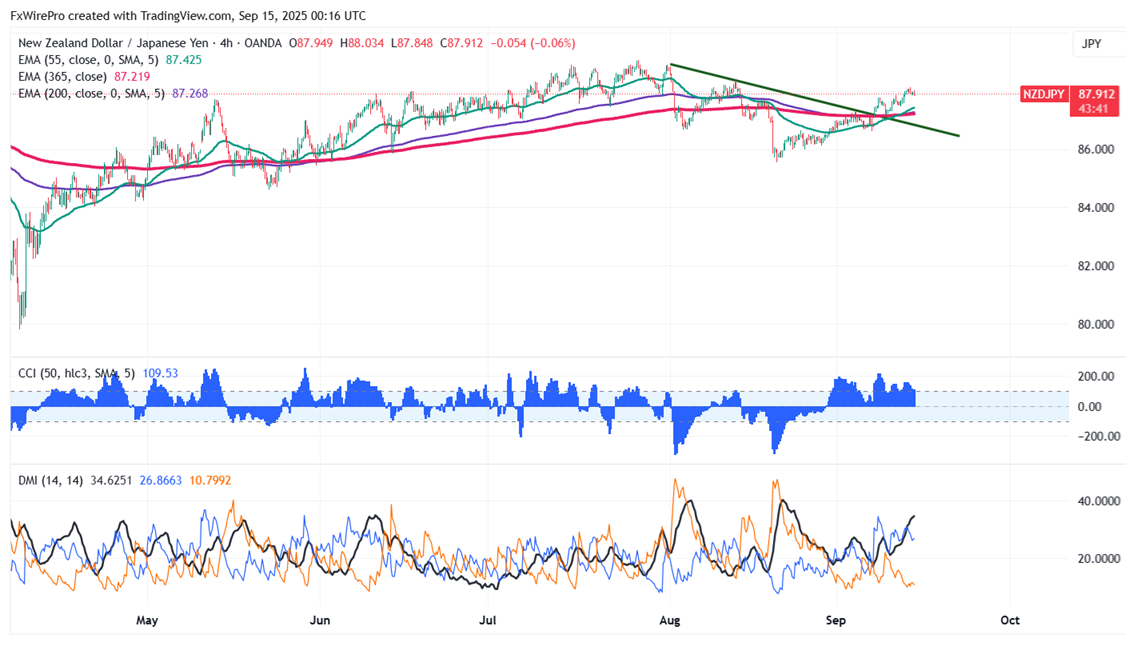

NZDJPY trades higher for the third consecutive week on a strong New Zealand dollar. Intraday trend remains bullish as long as support 87.20 holds. It hit a high of 88.12 yesterday and is currently trading around 87.92. The overall bearish trend is intact as long as the resistance at 89.20 holds.

Technicals-

The pair is trading above 55 EMA, 200-EMA, and 365 EMA on the 4-hour chart.

The near-term resistance is around 88.20, breach above targets 89.20/90. The immediate support is at 87.40; any violation below will drag the pair to 87.20/87/86.65/86/85.50/85.10/84.06.

Indicator (4-hour chart)

CCI (50)- Bullish

Average directional movement Index- Bullish. All indicators confirm a bullish trend.

It is good to buy on dips around 87.40 with SL around 87 for TP of 89.20/90.

FxWirePro: GBP/USD regains upwards momentum but unable to hold above 1.3700 level

FxWirePro: GBP/USD regains upwards momentum but unable to hold above 1.3700 level  EUR/GBP Slumps Under Pressure: Bearish Momentum Builds as 0.8675 Resistance Holds Firm

EUR/GBP Slumps Under Pressure: Bearish Momentum Builds as 0.8675 Resistance Holds Firm  FxWirePro- Woodies Pivot(Major)

FxWirePro- Woodies Pivot(Major)  USD/CHF Breaks Out: Bullish Surge Past 0.7800 Fuels Fresh Upside Momentum

USD/CHF Breaks Out: Bullish Surge Past 0.7800 Fuels Fresh Upside Momentum  FxWirePro: USD/CAD extends gains, eyes 1.3800 level

FxWirePro: USD/CAD extends gains, eyes 1.3800 level  FxWirePro: NZD/USD consolidating around 0.6030 , bias is bullish

FxWirePro: NZD/USD consolidating around 0.6030 , bias is bullish  FxWirePro- Woodies Pivot(Major)

FxWirePro- Woodies Pivot(Major)  FxWirePro: GBP/AUD dips ahead of pivotal RBA call

FxWirePro: GBP/AUD dips ahead of pivotal RBA call  FxWirePro: GBP/NZD remains weak, eyes 2.2550 level

FxWirePro: GBP/NZD remains weak, eyes 2.2550 level  FxWirePro- Major European Indices

FxWirePro- Major European Indices  FxWirePro: AUD/USD jumps after RBA rate hike

FxWirePro: AUD/USD jumps after RBA rate hike  FxWirePro: USD/CAD attracts selling interest, vulnerable to more downside

FxWirePro: USD/CAD attracts selling interest, vulnerable to more downside  FxWirePro: AUD/USD remains buoyant, looks to extend gains

FxWirePro: AUD/USD remains buoyant, looks to extend gains  FxWirePro: GBP/USD attracts selling interest, vulnerable to more downside

FxWirePro: GBP/USD attracts selling interest, vulnerable to more downside  FxWirePro: USD/ZAR dips below lower range, bearish bias increases

FxWirePro: USD/ZAR dips below lower range, bearish bias increases