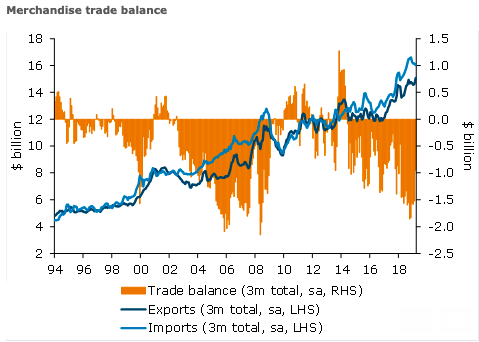

New Zealand record-high exports in March saw a larger-than-expected monthly trade surplus, and a narrower annual deficit; demand from China remains robust. The unadjusted monthly trade balance posted a solid $922 million surplus in March, well above market, expectations of $300 million and $130 million respectively.

On a seasonally adjusted basis, exports increased 11.5 percent m/m, with all major categories except seafood rising. Values for both meat and dairy rose 7.4 percent m/m, with solid volumes growth broadly keeping pace with prices. A 17 percent rise in forestry volumes more than offset lower prices, with values up 3.1 percent.

Seasonally adjusted imports fell 1.3 percent m/m, with weakness concentrated in textiles (down 26.9 percent). Machinery imports made the second-largest negative contribution, down 3.5 percent m/m.

China remains at the top of the export destinations list, up a whopping 52.1 percent versus March last year. Year-to-date exports to China trended higher, up 20.8 percent y/y. Despite growth concerns and slowing global trade flows, Chinese demand for New Zealand dairy, meat and logs has remained very robust. Long may it continue, ANZ Research reported.

Over Q1, the seasonally adjusted goods deficit narrowed $700 million to $1.0 billion, with exports up 2.0 percent and imports down 2.5 percent. Strong milk solids production earlier in the season has boosted Q1 exports, with dairy volumes up 16.7 percent q/q. Weaker imports of both transport equipment and oil dampened imports growth. Consumption imports dipped, but remain elevated.

"Looking forward, we expect to see ongoing broad-based strength in export values. But in seasonally adjusted terms, it appears much of the pipeline strength for volumes is now working its way through the trade data, suggesting positive net exports contributions to GDP growth are poised to fade heading into mid-2019," the report added in its comments.

Image Courtesy: ANZ Research

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022