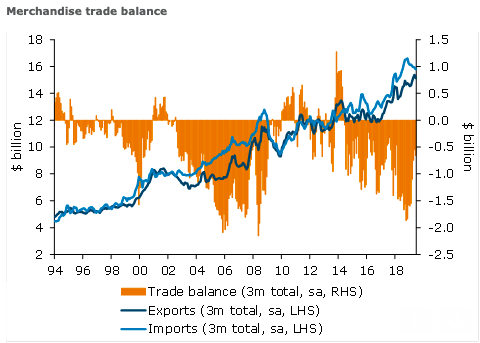

New Zealand’s exports returns fell sharply in June from the record returns recorded in May on the back of reduced export volumes for dairy, meat, and forestry products. Despite the weaker export data the monthly unadjusted trade surplus widened due to weak import data, according to the latest report from ANZ Research.

June delivered an unadjusted monthly trade balance of $365 million, more than double the revised surplus for the previous month. Exports of logs returned nearly as much as the previous month with returns up 16 percent y/y for the month of June on a seasonally adjusted basis.

The recent sharp correction in log price and associated fall in exports will be more noticeable in next month’s data. Both dairy and meat volumes have eased which is normal for this time of the season but the rate of fall was greater than expected for dairy.

On a seasonally adjusted basis, exports increased by 0.6 percent m/m while imports fell 4.0 percent m/m. Imports were driven down by a 34.4 percent fall in the value of petrol and petroleum products imported. Imports of machinery were also weak, down 12.6 percent, with a sharp reduction in the value of textiles and plastics as well.

The fall in petrol imports follows a massive lift the previous month, with the timing of ships docking influencing the monthly data. During the first half of this year petrol imports are only tracking 2 percent behind the corresponding period the previous year.

The trend towards exporting more product to China continues. Exports to China have increased by 23.6 percent in the past 12 months. This has primarily been driven by additional exports of logs and meat to this market, while it remains the largest market for dairy products.

"Looking forward, we expect to see export volumes weaken further in July as the volume of dairy and meat production is at its seasonal low and the felling of trees slows due to the recent fall in log prices," the report further commented.

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility