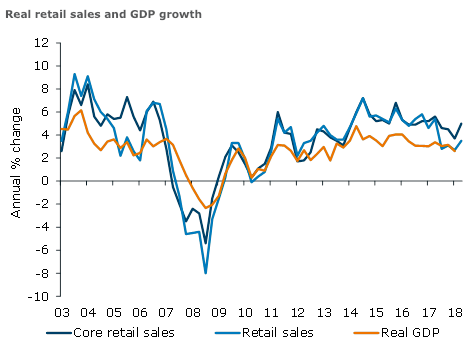

New Zealand’s retail sales came in stronger than market expectations at +1.7 percent q/q during the fourth quarter of 2018, boosted by a solid core, after a flat print in Q3. That said, there still remains a modest downside risk to Q4 GDP (0.6 percent q/q), according to the latest report from ANZ Research.

There are more pieces of the puzzle to come, but the RBNZ may be setting themselves up for disappointment (expecting 0.8 percent q/q for Q4 GDP) – though indicators of capacity pressure will also be important to watch.

Core retail volumes, which exclude volatile components like petrol, were up 2.0 percent q/q – to be up 5.0 percent over the past year. This points to a solid spending pulse, supported by solid disposable income growth, and potentially a lagged effect of the Families Package. With petrol prices on the decline, fuel volumes rose 1.0 percent q/q in the quarter. In nominal terms, total spending was up 1.8 percent.

Housing-related spending was on the weaker side, with furniture, floorcoverings and houseware down 1.3 percent q/q (the third quarter of decline), hardware down 2.1 percent, and department store spending down 2.6 percent.

Clothing (4.1 percent), electronics (4.6 percent), and pharmaceuticals (8.2 percent) all got a boost, while there was more wining and dining – with spending on food and beverage services up 4.2 percent. Accommodation spending continues a solid run (1.9 percent q/q).

"Broadly speaking, we expect private consumption (and retail spending) growth to gradually moderate from here. High levels of household debt, slowing population growth, a cooling housing market, around-average consumer confidence, and some concerning global growth signals should be sufficient to prevent an acceleration," the report added.

Image Courtesy: ANZ Research

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens

Australian Pension Funds Boost Currency Hedging as Aussie Dollar Strengthens  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength