Recently India has been in news in relation to non-performing loans at banks, which has reached in some banks more than 10%. After Reserve bank of India (RBI) forced bank to recognize non-performing loans (NPL) and asked to take stringent measures, many high profile NPL cases have come into the spotlight. Such has been the case of India’s Liquor Barron Vijay Mallya’s, which is now being covered by international media after he allegedly absconded India.

Due to this sharp rise in NPLs after RBI’s stringent rules, Indian banks got battered down most of which now trading well below their book value. Despite Government in this year’s budget infusing INR 25,000 crore capital into state run banks, gap is quite large. For example Vijay Mallya alone owns INR 9000 crore to Indian banks.

Despite being battered, we expect Indian banks to regain their lustre over time since RBI forced the skeletons out of closet. Even International Monetary fund (IMF) chief, Christine Lagarde recently applauded RBI’s approach.

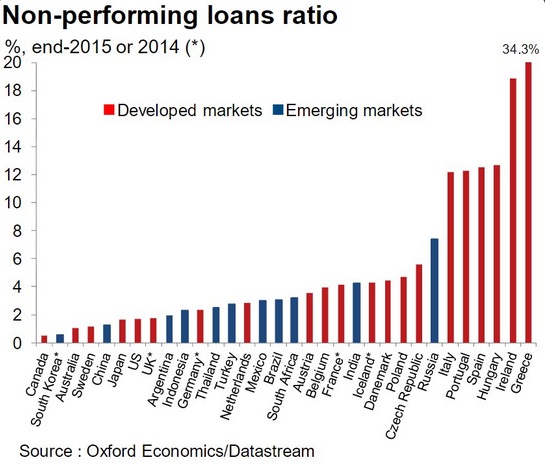

While Indian NPL problem might begin to get solved over time, Latest research by Oxford Economics suggest NPL is a global phenomenon. Moreover it is clearly not an emerging market issue, several developed economies are suffering from it. Kindly refer to the chart from Oxford economics for details –

- Surprisingly top six countries suffering from biggest percentage of NPLs are from Europe. Italy, Portugal, Spain, Ireland, Hungary and Greece, for which the percentage is at staggering 34.3%.

- Russia and India have biggest levels of NPLs among emerging markets.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX