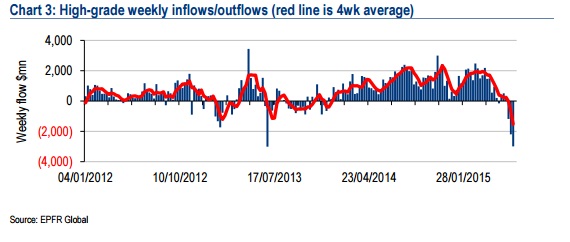

Retail crowd remains concern over Greek spillover and takes money out of bond funds for third consecutive week.

The chart shows weekly flow of funds. Chart courtesy EPFR Global and Financial Times.

- European high grade bond funds saw net outflow of around $3 billion for the week ending on 24th June. Euro denominated bond outflow was highest at $2.1 billion, sterling based saw $255 million outflow.

- Investment grade ETF's experienced outflow of $416 million.

- Fixed income fund saw outflow of $5.1 billion for the week.

While investors pull money out of bonds, equities remain in favor.

- For the week ending on 24th June, equities in Europe saw net inflow of $3.4 billion.

- Equity ETFs saw inflow of $1.8 billion for the same period.

Recent spike and volatilities in the bond market is another reason besides Greece, in investors' taking money out of bonds.

Bonds especially the longer dated ones, provides unattractive yields and remain at risk if inflation returns more rapidly.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary