The FY2019 (fiscal year ending March 2019) union budget, due next Thursday, February 1, will be the last full year budget of the Modi government before the general election in 2019. It will also be the first full-year budget under the GST regime.

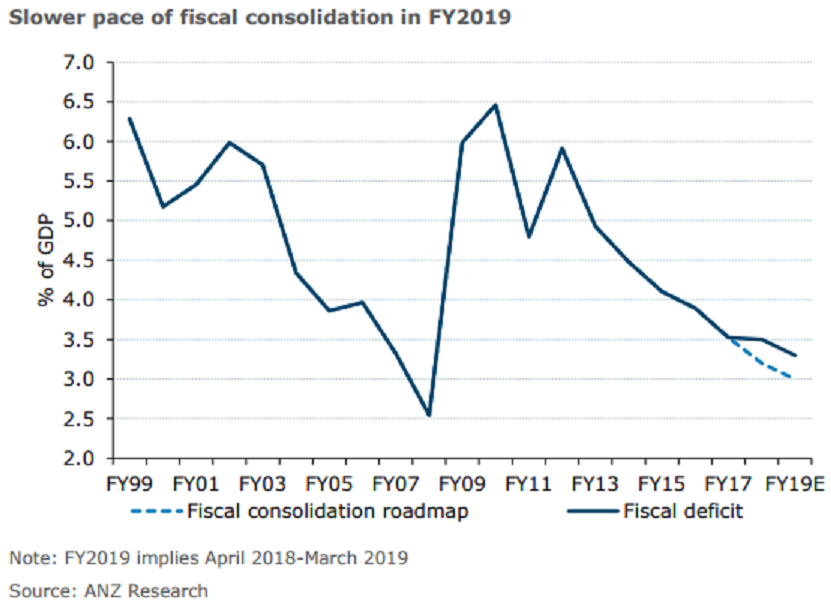

The government expected FY2019 fiscal deficit at 3.3 percent of GDP, higher than that what the initial medium term consolidation path had warranted. For FY2018, fiscal deficit is expected at 3.5 percent of GDP versus the government’s target of 3.2 percent. Also, the fiscal stance is unlikely to be inflationary on its own. The fiscal slippage in FY2018 is an outcome of lower-than-expected revenues rather than higher expenditure.

Additionally, the expenditure mix in FY2019 budget is likely to show steady growth in capex, which is less inflationary compared with revenue expenditure. Further, the CPI is expected to average 5.1 percent in FY2019, higher than our estimate of 3.6 percent in FY2018.

"We continue to expect the central bank to keep the repo rate at 6.00 percent in 2018. However, it is likely that the underlying rhetoric in the policy statements will remain hawkish," the report added.

Lastly, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran