The minutes from the ECB meeting July 20-21 showed the central bank was cautiously optimist and keen to contain stimulus hopes at meeting after Brexit vote. There was general agreement among the ECB Governing Council on the outlook, risk and policy actions post-Brexit. Members felt it was too early to assess with any certainty the possible implications of UK referendum. Members, therefore, felt it was premature to discuss any possible monetary policy reaction at this stage.

At its July meeting, the ECB stopped short of signaling that it would boost its stimulus again soon. Mr. Draghi has urged investors to wait to see the full effects of its recent policy measures, which include subzero interest rates, €80 billion ($90.18 billion) a month of bond purchases and cheap loans for banks.

There was broad agreement that the monetary policy measures in place since June 2014 continued to contribute to favourable bank lending conditions and to a strengthening of credit growth. Inflation was expected to increase further over the coming years owing to stronger domestic demand, tighter labour markets and improved corporate profitability, supported by the pass-through of the ECB’s monetary policy measures.

Overall, there was wide agreement that downside risks to the economic outlook for the euro area had increased. Members viewed that the Governing Council needed to reiterate its capacity and readiness to act, if warranted, to achieve its objective, using all the instruments available within its mandate, while not fostering undue expectations about the future course of monetary policy.

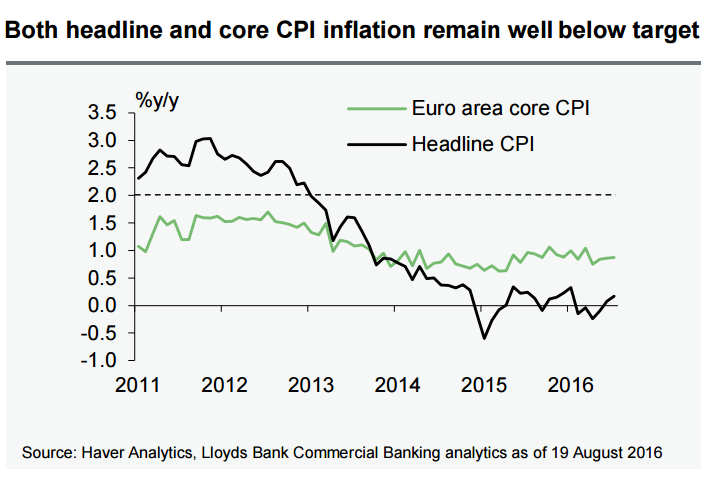

ECB's next monetary policy meeting will take place on September 8 in Frankfurt and economic data, particularly inflation will be the main consideration. Data released on Thursday showed that eurozone inflation was 0.2 percent in July, still far below the ECB’s target of just under 2 percent, with core inflation running at 0.9 percent. With core inflation not trending higher, still indicating modest price pressure and the economic outlook uncertain, most economists still expect the ECB to announce fresh policy measures in September when new economic forecasts will factor in the likely impact of Brexit.

Capital Economics forecasts the ECB would up the pace of its monthly asset purchases to 90 billion euros ($102 billion) from 80 billion euros, extend the purchasing program by six months and cut the deposit rate to -0.5 percent in September. "It is quite possible the bank will hold at least one of these measures back for later, but we are convinced that all three will be needed before long," Jennifer McKeown, economist at Capital Economics, said in a report on Thursday.

EUR/USD was trading at 1.1322 at around 10:30 GMT, down 0.26 percent on the day.

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns