After changing its calendar to accommodate its decision right after the FOMC, Banxico seems to be waiting for the Fed to make a move. For now, the board will be very comfortable if the Fed delays its first hike during H2 15.

"However, as inflation accelerates in Q1 16, Banxico might hike regardless of any Fed action in order to maintain inflation close to target throughout 2016. In that sense, as time passes and inflation accelerates, Banxico will become less dependent on the Fed", says Barclays.

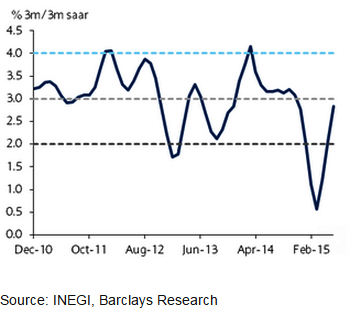

Mexico CPI increased 0.17% m/m in June, a bit lower than market forecasts, as a result of unexpected declines in fruit and vegetable prices. However, core inflation was 0.21% m/m, in line with expectations. Annual inflation remained stable at 2.9% y/y.

"Year-end forecast is at 2.6% y/y, as base effects are still expected to dominate in H2 15, while core inflation will likely accelerate with better growth. In fact, core inflation rose suggesting that the economy gained steam last quarter", added Barclays.

Mexico's core inflation suggests better economic conditions

Friday, July 10, 2015 5:59 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX