As a result of the Mexico IP slowdown, the labour market showed some signs of stagnation in Q2 if not deterioration. In May, the IP posted its first negative yoy print in over a year and appears that growth has slowed significantly in H1 even if we do not see anything seriously wrong with the economy going into H2.

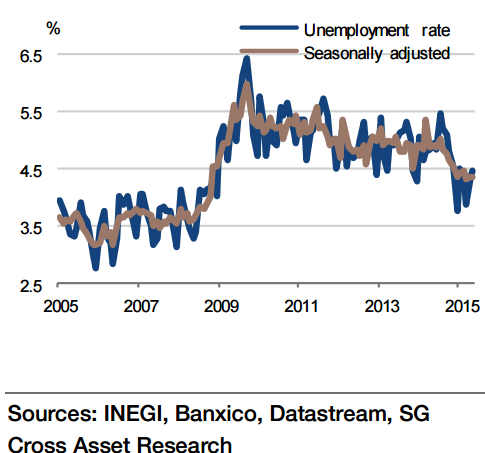

"Based on the forecast of 4.42% in June, the unemployment rate likely rose in Q2 to 4.4% from 4.2% in Q1 although the seasonally adjusted series shows it likely remained unchanged at 4.4% in Q2", says Societe Generale.

The more stable seasonally-adjusted rate has hovered between 4.24% and 4.41% over the past few months. Q2 increase notwithstanding, both theseindicators have declined between 0.5% and 1.0% over past 12 months and are nearly at levels last seen in 2008.

"Moreover, with the economy likely to accelerate again in H2 and beyond, the deterioration in labour market conditions is expected to be temporary", added Societe Generale.

Mexico labour market deterioration in Q2 likely to be short lived

Friday, July 24, 2015 5:33 AM UTC

Editor's Picks

- Market Data

Most Popular

5

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022