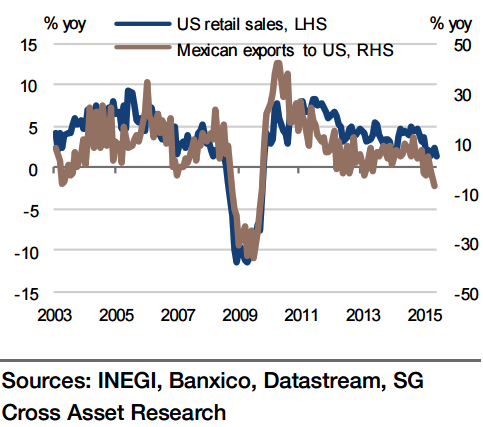

Mexican trade numbers this year have been considerably weaker than expected and recent numbers suggest that exports (and imports) weakness have deepened in Q2 following the demand weakness in the US, which constitutes nearly 80% of the total Mexican exports market.

Exports and imports fell by - 3.5% yoy and -1.5% yoy in June leading to a trade deficit of -$289m compared with a deficit of -$1017m in May 2015 but a surplus of $386m in June 2014. In sum, the near-term trade weakness is primarily due to low demand growth in the US and it feeding into the manufacturing growth back home.

"With US growth expectations for H2 remaining strong, the trade numbers are expected to improve from July onwards", says Societe Generale.

Falling oil prices have hit both the external account and Mexico's public finances. As a result, the current account balance has deteriorated by between 0.5% and 0.8% of GDP on a structural basis, and it would take considerable improvement in manufacturing exports or penetration of new markets to see the current account return to its former size.

"In general, stronger manufacturing export growth in H2 2015 and 2016 should help keep the current account balance unchanged, although lower oil prices could also keep it from improving", added Societe Generale.

Mexican exports facing low demand growth from US

Monday, July 27, 2015 4:16 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed