While WTI benchmark for crude has wiped out almost 20% of its values this year so far, US Dollar has remained well bid but not much of a rising star. Its performance has been mixed. It is up by 0.5% against a broad basket of currencies and up against emerging market counterparts including Yuan.

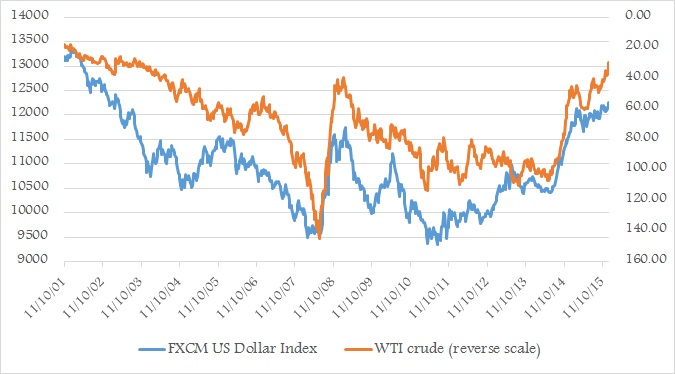

However Dollar's close proximity to drop in oil price as shown in the figure suggests significant further appreciation in US Dollar could push oil into further lows.

Correlation between the two clears some air of confusion. 4 week rolling correlation between WTI and FXCM US Dollar index currently is at -98% suggesting importance of strong Dollar for crude market, however 12 week rolling correlation is at -39%, which is clearly suggests there other factors, such as global supply glut is at play other than strong Dollar.

Nevertheless, since crude is quoted in Dollar, it is naturally will play crucial role for future moves but for such Dollar's move has to be significant.

WTI is currently trading at $29.7/barrel.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed