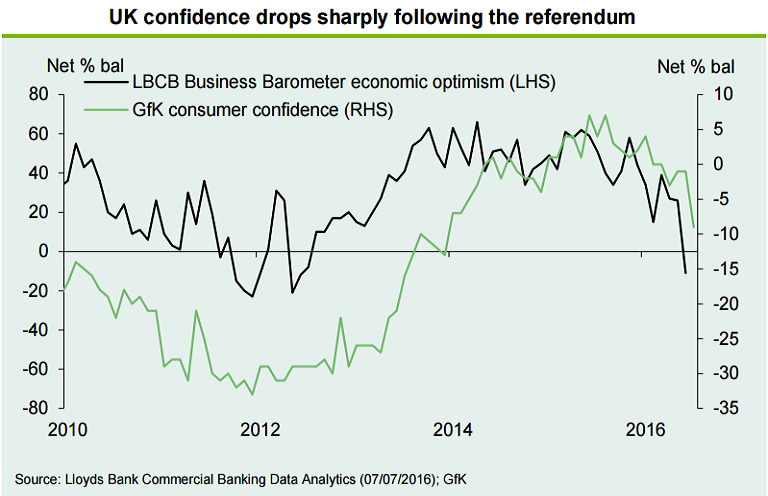

UK Monetary Policy Committee will meet on Thursday, July 14th, for the first time following the EU referendum result. Attention is now focused on how policymakers will respond to the Brexit vote. Market expectations riding high for a base rate cut amid the heightened uncertainty. The prospect of more monetary stimulus has pushed bond yields and the pound to fresh lows. According to a survey in the Financial Times, markets "have already priced in a 75% chance of interest rates being cut from 0.5% to 0.25% this week."

The Thomson Reuters consensus forecast is for the rate to remain unchanged at 0.5%. Credit Suisse analysts in a note to clients on Friday morning said they expect the bank to cut the benchmark Bank Rate by 45 basis points to 0.05% and announce additional QE, likely in the region of £75 billion ($96 billion). Capital Economics also expects the Bank of England to take action, although they suggest it will only cut the bank rate by 0.25% and that it won't restart QE until August.

BOE governor Mark Carney already reiterated at a press conference on July 5th that the BoE is ready to inject as much as £250 billion ($324 billion) of extra capital into the financial system, in case of an economic downturn caused by a Brexit. Governor Carney may give more clarity when he speaks on Tuesday.

Headline inflation rates in the UK continue to reflect prior declines in commodity prices, while stable core inflation rates continue to suggest little risk of outright deflation. That said, the MPC is likely to closely monitor the move in the exchange rate. At current levels, sterling looks only modestly undervalued and potential for further declines looks high. But policy makers are probably not too concerned about a weaker pound as it will support export growth.

Despite being downgraded by credit rating agencies demand for UK debt remains strong as evidenced in the fall in UK government bond yields. If fiscal stimulus is used and deployed correctly, boosting productivity and longer term growth rates should see a further rise in government bond yields.

UK bond yields rates have continued their inexorable decline. Over the past week, the yield on the UK 10-yr gilt has dropped another 15bps to just above 0.7%. The yield on the benchmark 10-year gilt fell nearly 2 bps to 0.717 pct, yield on super-long 40-year bonds dipped 1-1/2 bps to 1.386 pct and the yield on short-term 3-year bonds slid 1 bp to 0.203 pct by 09:40 GMT today. Cable was trading at 1.2963 at 1115 GMT.

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook