Federal Reserve Chair Janet Yellen's congressional testimony gave a rather upbeat assessment of the US economy, consistent with the Fed’s expectation of further gradual increases in interest rates. In a testimony before the Senate on Tuesday Yell reiterated the Fed’s December prediction of three increases in 2017. However, she refrained from giving a specific date for rate rise.

Yellen's description of labor markets was constructive. She said that the unemployment rate was little changed over the last year. Standing at 4.8 percent in January, the unemployment rate is at the median of FOMC participants’ estimates of its longer-run normal level. She noted that wage growth has picked up and reflects further job market tightening.

Comments on inflation were brief. Yellen said inflation has “moved up over the past year, mainly because of the diminishing effects of the earlier declines in energy prices and import prices.” On inflation expectations, she noted that market-based measures of inflation compensation have moved up from “very low levels” but remain “low” nonetheless.

Yellen said that even though the Fed expects to hike gradually and to keep policy accommodative, getting rates back to normal levels is important and hikes will be considered ahead. Yellen will complete her semi-annual testimony today, presenting to a House panel, although, there is likely to be few surprises given she only spoke yesterday.

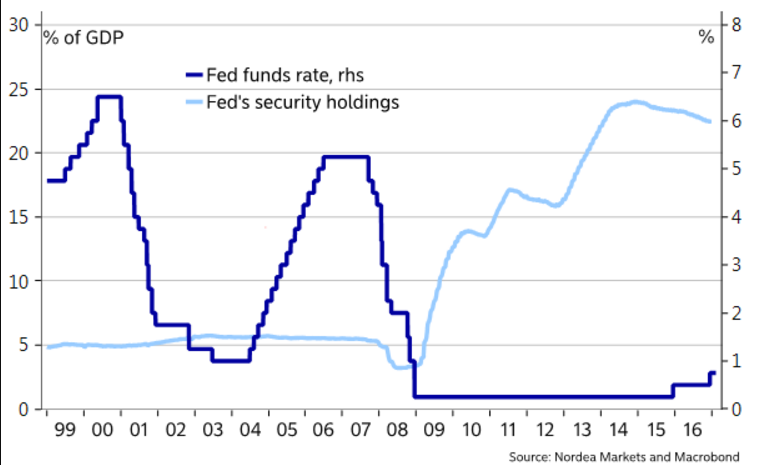

The Fed's monetary policy report, also released on Tuesday reiterated that the FOMC anticipates continuing to fully reinvest repayments from its bond holdings until rate hikes are “well under way”. Yellen said that while it is a “longer-run goal” to shrink the Fed’s balance sheet to a point where it will be “substantially smaller” in the future, she didn’t see that process as an “active tool” to manage monetary policy in place of interest rate rises.

"Altogether, we view her comments as indicating that the median of three rate increases in 2017 that the Fed set out in its December forecasts remains in place. We retain our outlook for two rate increases in 2017, two more in 2018, and balance sheet reduction in early 2019." said Barclays Research in a report.

The implied probability of a 25bp hike in March rose to 34 percent (from 30 percent). Overnight, the USD consolidated but with EURUSD below 1.05 and USDJPY above 114. EUR/USD was trading at 1.0552, while USD/JPY was trading at 114.43 at 1220 GMT. FxWirePro's Hourly USD Spot Index was at 46.9886 (Neutral). For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady