According to data released by Malaysia’s Department of Statistics, Malaysia’s gross domestic product (GDP) grew well beyond expectations in the first three months of 2017, powered by the manufacturing and services sectors. Malaysia’s economy expanded at 5.6 percent y/y in Q1, beating estimates of 4.8 percent from economists polled by Reuters. On a quarter-on-quarter seasonally adjusted basis, GDP grew 1.8 percent, faster than the 1.3 percent registered in the preceding quarter.

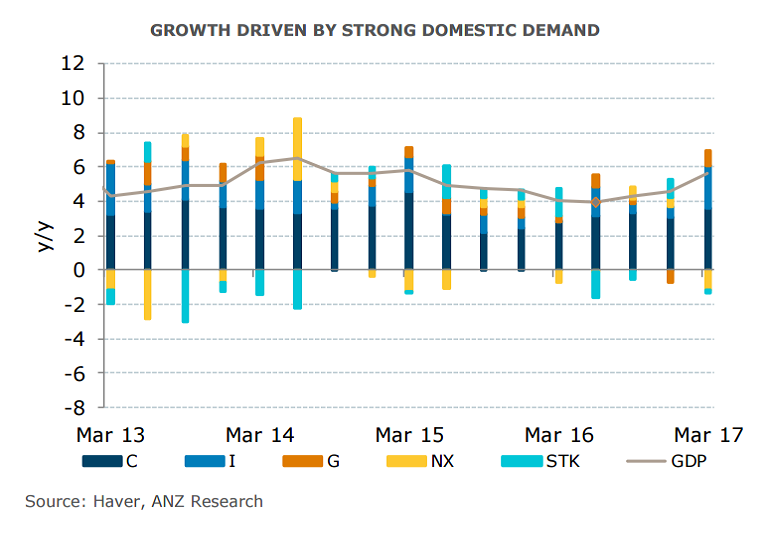

Growth was largely driven by private consumption, which rose 6.6 percent y/y and contributed 3.6 percentage points (ppt) to headline GDP growth. Growth in manufacturing accelerated to 5.6 percent from 4.7 percent in the previous quarter, while services rose 5.8 percent. Gross fixed capital formation also surged 10 percent y/y. In all, final domestic demand (including inventories) contributed 6.8 ppt while net exports subtracted 1.2 ppt from headline growth.

Annual consumer price inflation hit an eight-year high in March at 5.1 percent, though it slowed to 4.4 percent in April. The Bank Negara Malaysia (BNM) has said inflation averaged at 4.3 percent in Q1. Higher oil prices was seen as the main driver behind the spike in inflation. BNM Governor Muhammad Ibrahim said that the central bank still expects inflation to come in at 3-4 percent. He noted that there is some uncertainty in global markets, but added that inflation is largely cost driven and not due to demand.

"At this juncture, growth dynamics, though improving, do not point to the emergence of strong demand pull inflationary pressures. Hence, there is limited pressure on Bank Negara Malaysia (BNM) to hike rates," said ANZ in a report.

Malaysia's current account surplus narrowed to MYR5.3bn in Q1, from MYR12.3bn in Q4 2016. This continues against the backdrop of a narrower goods account balance surplus of MYR25.3bn (Q4 2016: MYR31.4bn) and widening service (MYR6.2bn) and income deficit (MYR13.8bn). Consequently, the current account surplus narrowed to 1.6 percent of GDP in Q1 from 3.8 percent in the preceding quarter.

"A recovery in commodity prices should help bolster the current account surplus in the coming quarters, though the surplus is still likely to remain low by past standards," Capital Economics said in a note.

The ringgit, one of the region's worst performing currencies, in 2016, has strengthened about 3.7 percent against the dollar so far this year. USD/MYR was trading at 4.3205 at the time of writing, down 0.13 percent on the day. Price action has broken below major 200-DMA support at 4.3281 and technical indicators support further downside in the pair.

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings