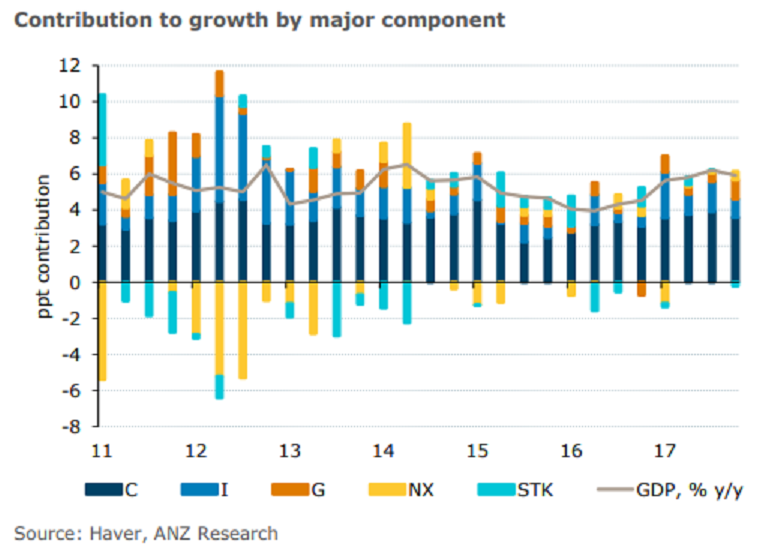

Malaysia’s full-year economic growth is expected to remain solid at 5.8 percent y/y, according to a recent report from ANZ Research. The country’s Q4 GDP growth moderated to 5.9 percent y/y and 0.9 percent q/q (s.a.) from 6.2 percent y/y in the previous quarter.

This translates into a 5.9 percent increase for the full year 2017, up from 4.2 percent in 2016. Underpinning this performance was continued strength in private consumption and investment as well as a pick-up in government consumption.

The moderation in investment was largely in the public sector presumably reflecting the lumpiness of government infrastructure projects. Private investment, on the other hand, strengthened during the quarter. Overall, the full year 2017 growth was solid and broad-based.

However, the outlook for 2018 is positive, reflecting a combination of favorable external and domestic demand conditions. The spill-over from external to domestic demand via higher manufacturing sector wages and investment activity has been quite prominent in Malaysia. The positive growth outlook is also consistent with the consumer and business sentiment data.

"BNM’s more constructive outlook on inflation notwithstanding, we believe that it will take advantage of this phase of strong growth to further normalize monetary policy. We continue to expect a 25bps hike in September, taking the year-end policy rate to 3.50 percent," the report added.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target