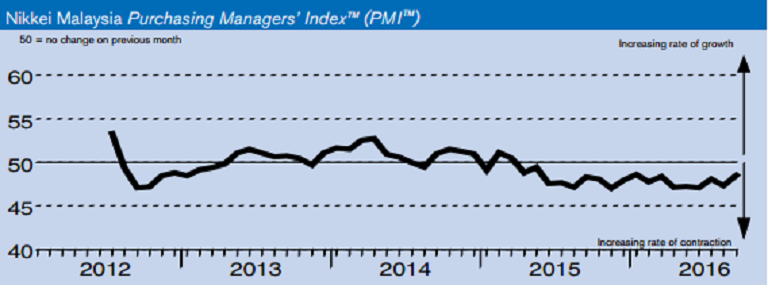

Manufacturing conditions in Malaysia worsened at a slower pace at the end of the third quarter of this year, as both production and new orders contracted at weaker rates during the period. On the price front, input price inflation rose to the joint-strongest in the series history to date.

The headline Nikkei Malaysia Manufacturing Purchasing Managers’ Index (PMI) posted 48.6 in September, up from 47.4 in August, data released by Nikkei Markit showed Friday. This, further, signaled a weaker deterioration in operating conditions at Malaysian manufacturers. Moreover, the latest figure was the highest since January 2016 and greater than the average over the current 18-month sequence of readings, but below the 50-point mark that separates expansion from contraction.

New orders at Malaysian goods producers declined at the softest pace since May 2015. Data suggested that the primary factor behind the fall in total incoming new work was a decrease in international demand. Moreover, the survey found that production at Malaysian manufacturers decreased at the joint-weakest rate since October last year during September, IHS Markit reported.

Further, new export orders declined for the fourth month running and at the fastest pace in three months. A number of survey respondents mentioned a lack of demand from foreign clients and an unstable global economy as factors behind the fall in new exports.

Finally, input prices rose at the joint-sharpest rate in the series history to date. Higher raw material prices, unfavorable exchange rates and an increase in the sales tax were all commonly cited as factors behind the rise in cost burdens. Meanwhile, manufacturers cut back on their input buying at a quicker pace leading to a fall in stocks of preproduction items.

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances

Indian Refiners Scale Back Russian Oil Imports as U.S.-India Trade Deal Advances  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022