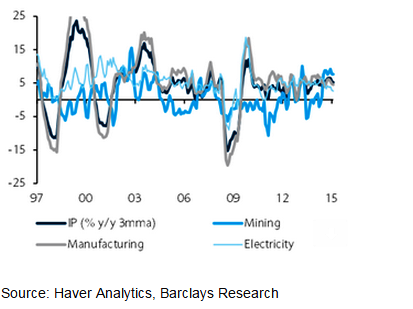

Today's Malaysia IP report (at 4.5%) comes on the back of May's poor trade performance, when exports fell by 8.7% y/y. Within the details, growth rebounded in mining, helped by strong increases in mineral fuel output and less of a drag from natural gas. Overall, the manufacturing sector's performance remains resilient, with electronics and food production still showing decent growth.

After a strong performance in Q1, momentum in growth is expected to moderate in Q2. Sectors such as palm oil have shown an acceleration in recent months, and private consumption is expected to improve in 2H 2015.

"However, overall growth rates are likely to remain healthy, 4.5% growth is forecasted for 2015", says Barclays.

While growth and consumption are likely to moderate following implementation of the GST, keeping rates on hold is consistent with the continued stability in growth, even as inflation appears to be less of a risk at this point. BNM is unlikely to raise rates anytime soon. Hence, rate hike call is expected Q4 15, to Q2 2016, when the economy is expected to have sufficiently recovered its momentum, and inflationary pressures to have turned more demand-led.

"For the month of June, headline CPI inflation is expected to touch 5.3%, mainly due to the rising price of pulses and the impact of the higher service tax rate which came into effect on 1 June", added Barclays.

Malaysia IP, the soft patch disappears

Friday, July 10, 2015 5:49 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX