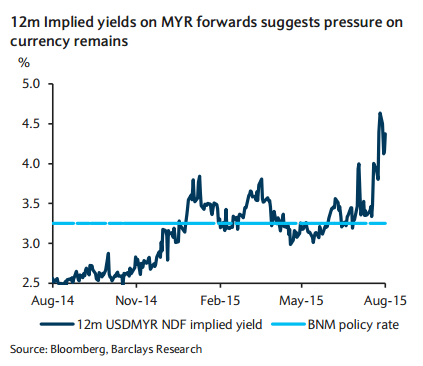

Lower oil, a high level of foreign ownership of local bonds, increased level of offshore borrowing and the recent increase in political noise have all hurt the MYR relative to other Asia FX. Although recent efforts by the BNM have helped to smooth spot movements, the pressure on the currency is evident in FX forwards. The 12m NDF implied yield stands at 4.2% versus the BNM's policy rate of 3.25% - suggesting that the market is wary of further currency depreciation and/or expects a tightening in monetary conditions to stabilize the situation.

Fundamentals still call for a weaker currency, and in rates the rich valuations and a restart of bill issuance are expected to help reprice the short-end MGS 10-15bp higher. The belly is expected to cheapen as ongoing commodity weakness and expected Fed lift-off risks make MGS the most vulnerable to position reduction in Asia.

"We expect 5y IRS to retest December highs of 4.24%," says Barclays.

MYR and MGS vulnerable as fundamentals deteriorate

Friday, August 7, 2015 12:20 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022