It is expected Mexican headline inflation to have moderated slightly to 3.06% YoY in April, remaining close to Banxico's target level of 3.0%. The core component likely slowed marginally to 2.42% YoY basis.

Over the same period in Chile, we expect a substantial trade surplus on the back of falling imports, while exports growth should remain muted.

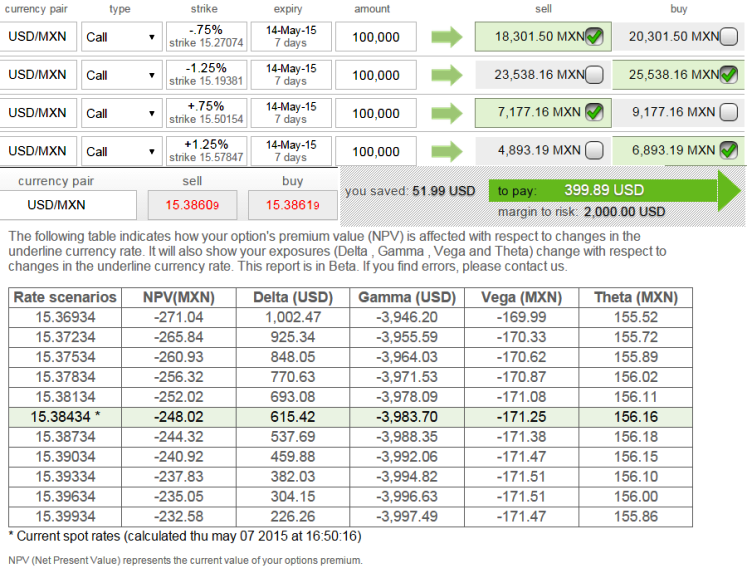

Currency derivatives strategy through Condor construction:

We foresee marginal upswings on daily charts of USDMXN in intermediate trend with clear converging signals from RSI (14) and stochastic curves. Although there is no trace of drastic or dramatic movements on either side we still sense some sort of bullish view.

Hence, here comes a multiple leg of option strategy for regular traders of this currency cross. A total of 4 legs are involved in the condor options strategy and a net debit is required to establish the position.

The trader can construct a long condor option spread as follows:

Selling a lower strike In-The-Money Call

Buying an even lower strike price In-The-Money Call

Selling a higher strike Out-Of The-Money Call

Buying another even higher strike price Out-Of-The-Money Call

Condor option strategy is best suited when the underlying currency is perceived to have low volatility. Despite the traders who anticipate limited risk and non directional trend, this option trading strategy is structured to earn reasonable profits.

Low volatility trading games on MXN through Condor spreads

Thursday, May 7, 2015 11:33 AM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand