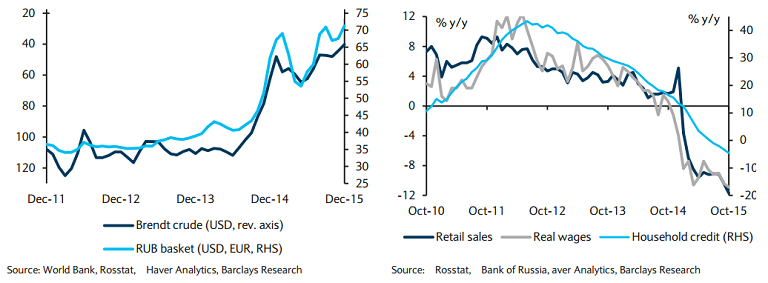

On 11 December 2015, the Bank of Russia decided to keep the key rate at 11.00 percent per annum, in recognition of growing inflation risks, but the risks of economic cooling remain. The bank estimates annual pace of consumer price growth in the end of 2016 to be about 6%, on the way to reach the target of 4% in 2017. Weakness in oil prices and the subsequent sell off of the RUB will help keep inflation subdued on base effects and thereby facilitate rate cuts beginning either at the next meeting at end-January or in mid-March. Real wages and retail sales will continue to declines in the November, while base effects and RUB weakness will likely help industrial production and real investment.

In Hungary, the NBH MPC meeting is due Tuesday, 15 December. The central bank, which has lowered interest rates to a record low and launched unconventional measures to fuel lending and growth, stands ready to employ more such unconventional means to stimulate the economy. The central bank could fine-tune its monetary easing toolkit in December, but expectations are for main interest rate to be kept hold at a record low 1.35 percent on Tuesday.

Hungary's headline CPI data for November came in at 0.5% y/y, slightly below expectations of 0.7%, while core inflation remained stable. But industrial production output, a leading indicator of real GDP, came in significantly stronger at 12.7% in the year to October, leading to the biggest October forecast surprise in this series since 2001.

"As a result of this positive news in the economy and the NBH's preference to loosen monetary conditions with more QE rather than cutting interest rates, we expect the NBH to remain on hold at 1.35% next week. We also expect Czech to remain on hold at 0.05% this week and to retain its exchange rate cap", says Barclays in a research note.

In the Czech Republic, November inflation disappointed, declining to 0.1% y/y from 0.2% in October, missing CNB expectations. With inflation well below the 1-3% target, the CNB is widely expected to keep its FX policy in place until at least H2 16, with the possibility of extension.

Poland's Monetary Policy Council kept the benchmark rate on hold at 1.50 percent earlier this month and ruled out a further cut to record low rates at the next policy meeting in January, saying economic growth was expected to accelerate next year. It will be interesting to watch Poland's release of the monthly external balance data tis week, along with the industrial production and retail sales figures. Expectations are for October current account and trade balances to come in at -€0.3bn and -€0.5bn, respectively.

Low CEE inflation supports accommodative monetary policy

Monday, December 14, 2015 11:44 AM UTC

Editor's Picks

- Market Data

Most Popular

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady