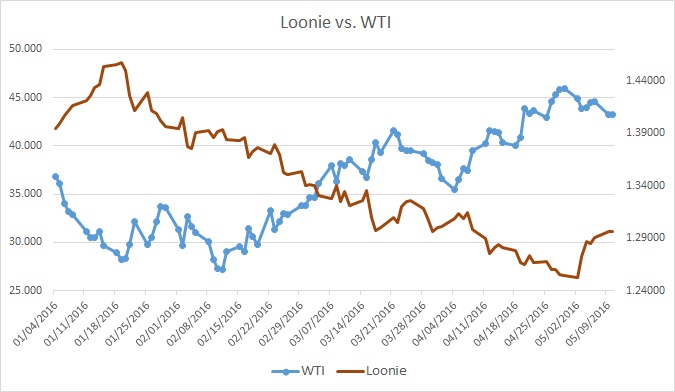

It is quite well known that Canadian Dollar and Oil are closely related since oil is Canada’s major export product. So, it won’t be anything new if we say that Loonie and oil from time to time maintains high correlation and this year as oil price is up more than 15% YTD, despite recent slump, Loonie is best performing developed market currency this year after Yen, with 6.3% gain against Dollar.

Above Chart 1 shows, how Loonie strengthened as oil recovered.

But there is more to this relation that meets the eye.

- From 29th January to 11th February, oil price declined by $9/barrel, from $33 to $27, but Loonie traded flat in the period against Dollar, with no decline.

- Again from 221st March to 4th of April, oil price declined by around $6/barrel, from $41 to $35, but Loonie declined but Loonie again flat against Dollar in the period.

So, we plot Loonie’s correlation to oil against WTI benchmark and it shows every time oil price goes up, correlation rises, benefiting Loonie but as oil sags, correlation drops to levels such as 2%.

Again as oil price is declining, Loonie’s correlation to oil is down from 95% to 42% as of now, indicating that oil price drop further may not weaken Loonie, going forward.

Our, second chart shows the correlation vs. Oil price.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed