Bank of America Merrill Lync's survey of global fund mangers' indicates that Dollar remains on the most crowded trade of 2015.

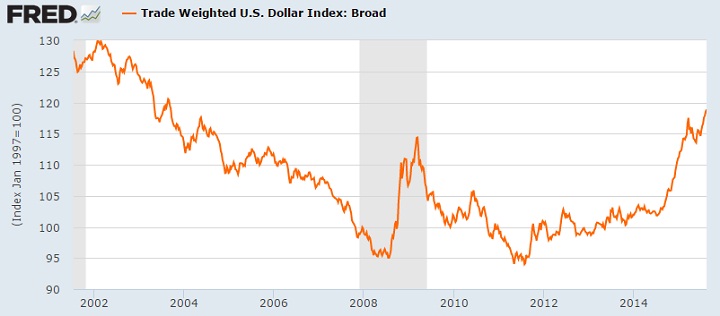

Trade weighted US dollar index now stands 118.87, just shy of September 2003 high around 120.

- Almost 45% of the fund managers surveyed in August are considering Long USD as most crowded trade, up from 35% in July. This suggests that retail traders should exercise caution heading into September FOMC. Even if the trend remains in place, possibility of larger correction is clearly building up.

After recent pull back, about 15% investors consider Long US high yield bonds as most crowded trade, compared to 20% in July.

About 10% of the investors are considering Long US tech stocks as most crowded trade, suggesting caution in picking up the stocks.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings