CFTC commitment of traders report was released on Friday (14th October) and cover positions up to Tuesday (11th October). COT report is not a complete presenter of entire market positions, however, it represents a good chunk of institutional traders, to feel what’s going on in capital markets and how big traders are aligned.

Kindly note, in some cases, numbers are rounded to nearest decimal.

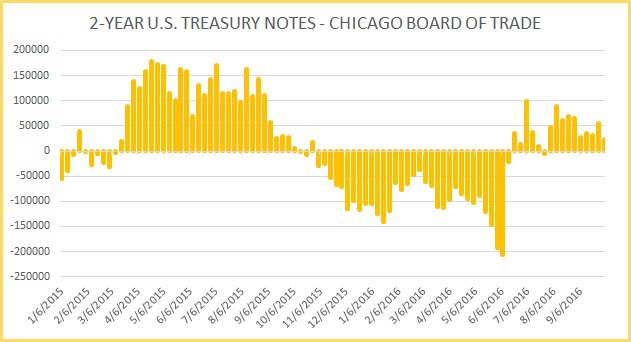

- 2 year U.S. Treasury:

With the rate hike from the Fed back in focus, traders decreased their long bets such a way that the net position flipped from long to short. The net-long positions decreased by 43,941 contracts to -19.9K contracts.

- 5 year U.S. Treasury:

5 year treasury saw another very sharp increase in net short position by 56,546 contracts that brought the net position to -271K contracts.

- 10 year U.S. Treasury :

Speculators sharply reduced their net long positions by 83,342 contracts to +43.8K contracts.

- S&P 500 (E-mini) –

Traders reduced their net longs for third consecutive week and the net position flipped from long to short. Net longs got decreased by 78,968 contracts and thus bringing net position to -33.8K contracts.

- Russell 2000 –

The net long positions decreased after increase in past two weeks. The net long positions increased by 3,648 contracts to +12.9K contracts.

- MSCI Emerging Markets Mini Index –

Investors reduced their exposures marginally after big rise in past two weeks. The net longs decreased by 2,009 contracts to +244.4K contracts.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022