CFTC commitment of traders report was released on Friday (10th March) and cover positions up to Tuesday (7th March). COT report is not a complete presenter of entire market positions, however, it represents a good chunk of institutional traders, to feel what’s going on in capital markets and how big traders are aligned.

Kindly note, in some cases, numbers are rounded to nearest decimal.

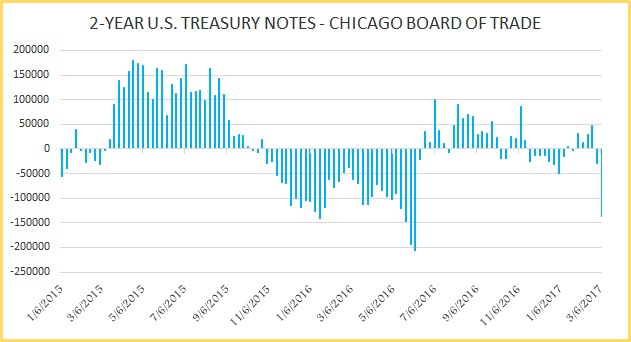

- 2 year U.S. Treasury:

After shifting from long to short last week, speculators sharply increased short positions. The net short positions were increased by 106,786 contracts and the current position is standing at -136.5K contracts.

- 5 year U.S. Treasury:

5-year treasury saw an increase in the short positions, where shorts were increased by 124,210 contracts that brought the net position to -411.6K contracts.

- 10 year U.S. Treasury:

Speculators sharply covered short positions and by 111,145 contracts to -298.5K contracts.

- S&P 500 (E-mini) –

Speculators increased their net long for the second consecutive week. The net long positions got increased by 51,003 contracts to +137.6K contracts.

- Russell 2000 –

Short positions were increased in such a way that the net position shifted from long to short. The net long positions decreased by 32,019 contracts to -12.3K contracts.

- MSCI Emerging Markets Mini Index –

After eight long weeks of increase, long positions were covered and in the tune of 4,188 contracts to +187.1K contracts.

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX