CFTC commitment of traders report was released on Friday (22nd July) and cover positions up to Tuesday (July 12th). COT report is not a complete presenter of entire market positions, however, it represents a good chunk of institutional traders, to have a feel of what expected by the big players.

Kindly note, in some cases, numbers are rounded to nearest decimal.

- Gold – Net position long and decreasing

Due to risk affinity environment, gold suffered another big drop in net long position. The net long position declined by 11,552 contracts to +285.9K contracts.

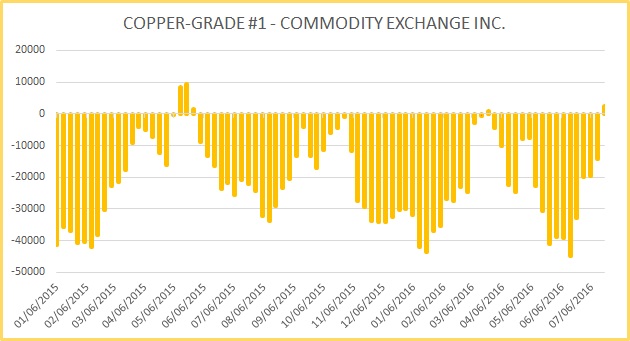

- Copper – Net position flipped to long

Copper net short position saw a large decrease and net position flipped from net short to net long. Net short position decreased by 16,594 contracts and the current position is at +2.4K contracts.

- Silver – Net position long and increasing

The net-long position in silver rose by 6,738 contracts to +94.4K contracts.

- WTI Crude – Net position long and decreasing

Crude oil saw a sizable decrease in net long positions by 5,214 contracts to +289.6K contracts.

- Natural gas – Net position short and decreasing

Natural gas registered a decrease in net short position by 2,333 contracts to -136.5K contracts.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022