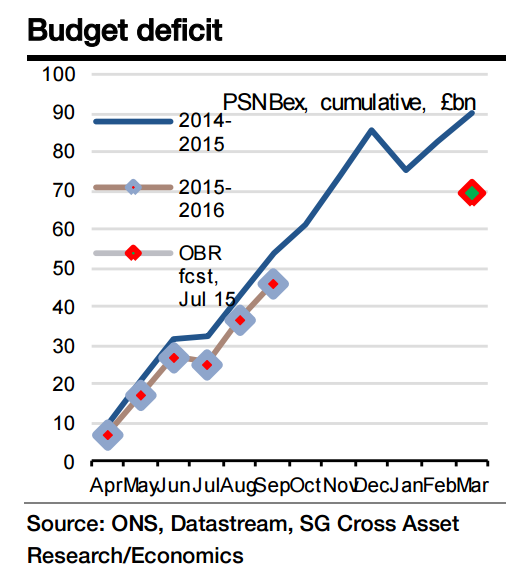

The UK budget deficit is falling but at nowhere near the pace projected by the OBR in its July forecasts (a fall of 22.9% for the full fiscal year). Tax revenues are rising at almost exactly the rate predicted by the OBR but spending is overshooting. We now have data for the first half of the fiscal year and it is looking increasingly unlikely that the OBR projection will be met. This week's data are for October which is a key month for corporation tax receipts.

The buoyancy of economic activity should make itself felt in corporate profits and thus in taxes but only expect the deficit to have improved at the average rate seen in the first half of the year. This will bring down the PSNBex from £7.1bn in October last year to £5.9bn, following £9.4bn in September. This will be the last set of public finance data before the Autumn Statement (AS) on 25 November.

Prior to the setback on changes to tax credits delivered in the House of Lords, it was not obvious what the reason was to hold another Budget, which what an AS is. Now, however, the Chancellor will use the AS to present a smoother transition to the new low tax credit levels but his problem will be that the OBR will probably raise its forecast of the budget deficit which will then require even greater cuts in the overall spending envelope than currently planned to get back to the planned deficit path. That will make it doubly difficult to find sufficient fresh cuts in other areas of public spending to allow gentler cuts in tax credits.

Last UK public finance data before the Autumn Statement

Thursday, November 19, 2015 10:47 PM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed