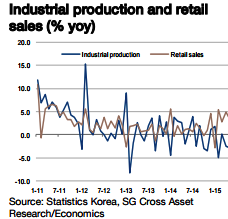

The latest macroeconomic data showed that the weakness in exports and industrial production, along with very low inflation, persisted until June. Industrial production contracted for a third consecutive month in May, and the apparent rebound in June exports was mostly driven by technical factors such as working days and the volatile shipbuilding sector.

June headline inflation rose a bit yoy due to food and energy prices, but core inflation declined to 2.0%, which means that ex-tobacco core inflation would be as low as 1.4%. A good deal of uncertainty still remains on the consensus outlook for growth and inflation, which is why further monetary easing is considered as a risk scenario, says Societe Generale.

Korea's weakness in IP and Exports to persist in June?

Wednesday, July 8, 2015 5:14 AM UTC

Editor's Picks

- Market Data

Most Popular