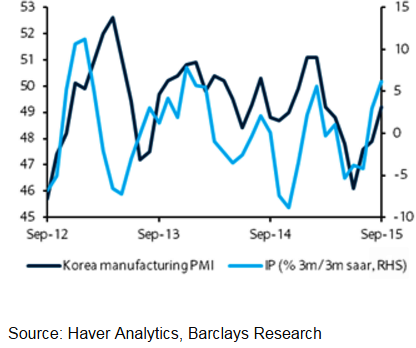

Korea's industrial output rose 2.4% y/y in September, better than expected, centered narrowly on resurgent memory chip production and, to a lesser extent, autos. On a seasonally adjusted m/m basis, IP rose 1.9%, helped partly by the downward revision to August IP.

The key concern is still the high excess inventories, with the inventory/shipment ratio, which came in at 1.28x in September, remaining close to the 1.30x peak reached in December 2008 during the global financial crisis.

The upside surprise in IP was driven by electronics, with output rising 11.6% y/y in September (Aug: 1.6%; July: -6.9%), driven by resurgent semiconductor production.

"Production of ships (with 4.5% weight in IP) shrank 19.5% y/y in September (August: -4.9%; July: -13.8%), likely driven by requests from customers to slow rig deliveries. On the other hand, auto production grew 14.5% y/y (Aug: +4.9%; Jul: -2.2%), helped by new launches in H2", says Barclays.

On a contribution basis, the lift came from electronics (+2.3pp) and autos (+1.4pp), which offset drags in metal products (-0.6pp) and vessels (-0.7pp). Within electronics, the strength was narrowly concentrated in semiconductors (+3.5pp), which offset declines in the other main electronics categories, components (-0.4pp), PCs (-0.2pp), telecoms (-0.4pp).

"The underlying growth momentum is likely to remain weak into 2016, and for the stance of monetary policy to remain accommodative well into next year. 2016 growth forecast is unchanged at 3%", added Barclays.

Korea's strong pre-holiday lift from semiconductors

Friday, October 30, 2015 4:19 AM UTC

Editor's Picks

- Market Data

Most Popular

2

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022