Exports plunged 10.9% y/y in May, broadly in line with consensus (-10.7%) but below the forecast (-9.0%). On a seasonally adjusted m/m basis, exports tumbled 6.5% (Apr: -1.2%; Mar: -0.8%), the largest m/m contraction since March 2012.

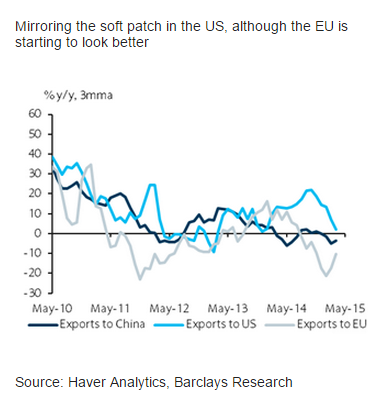

Excluding oil and petrochemicals, which contained most of the price distortions, exports still fell 6.2% (April: -3.1%). The poor performance was broad based by destination, with shipments to major partners all posting losses, particularly from east Europe, with shipments to Russia plunging 85% y/y for the first 20 days in May.

The weakness was compounded by lower refinery prices, one fewer working day and the weaker JPY. Furthermore, the soft trade report coincided with a deterioration in the manufacturing PMI to 47.8 in May (Apr: 48.8) and a jump in the inventory/shipment ratio to 1.27x in April (Mar: 1.24x).

More importantly, the inventory pile-up, sluggish exports and weakness in US retail sales could also reflect the broader disruption in the Asia-to-US supply chains that is still struggling to recover after the US West Coast port strike. That said, there are some silver linings.

Exports of mobile devices grew for the first time after contracting for four consecutive months (May: 26.6%; Apr: -8.6%), and EU-bound shipments also showed signs of recovery, with the exports in level terms reaching the highest in 10 months.

The US ISM new orders also rose to a five-month high of 55.8 in May (Apr: 53.5). All told, the extended period of soft activity indicators underscores the need for further stimulus and a weaker KRW bias.

Barclays notes:

- We expect more measures to be announced in June to weaken the currency, such as encouraging state-owned enterprises or state pension funds to step up overseas investment.

- We maintain our forecast for rates to stay on hold for the rest of the year and believe further easing will be data dependent - only if there are fresh downside risks to the BoK's revised growth forecast (3.1%).

- While we note the risk of a further rate cut, we think any easing would be less likely to occur before July - the next scheduled quarterly review of the economy.

- We continue believe there are soft hints of a moderate lift in growth momentum in Q2 and Q3, led by the US and euro area. As the picture becomes clearer, we expect this to support Korea's activity in late summer.

- With rates at an all-time low, we think more aggressive fiscal expansion (a larger supplementary package) and a weaker exchange rate bias are likely to play a larger role in the government's efforts to boost growth.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed