Watching the natural gas inventory is a must watch this year. Big profits can be made in the natural gas counter based on the inventory. Last two weak winters pushed the natural gas inventory to record high in 2015 to 4 trillion cubic feet. Naturally, with such a high level of inventory, natural gas price declined to $1.61 per MMBtu. The situation has improved a lot since then, both in the price front and in terms of inventories. Natural gas price has recovered and currently trading at $2.82 per MMBtu.

Due to last two weaker winters, higher injections inventory has still remained on the higher side, however, this year’s one of the hottest summers on record and increased use of natural gas for power generation has finally pushed inventory levels within the 5-year range.

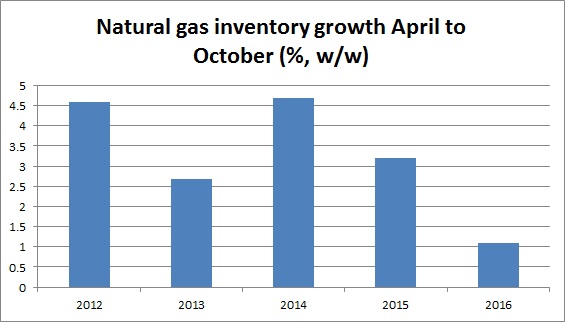

April to October is the typical net injection period. In 2012, inventory grew by 4.6 percent week over week in this period. For 2014, it was higher by 4.7 percent. Last year growth was 3.2 percent. But this year so far the growth has been just 1.1 percent. But again thanks to the factors like previous winters, inventory remain elevated and at a much higher level compared to all year since 2013, but the gap is reducing pretty fast. Yesterday’s weekly report shows, there was a net injection of only 11 billion cubic feet, while the market was expecting at least 18 billion.

If this trend of lower injections continues, then we are sitting on a big natural gas bull ride on a strong winter.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX