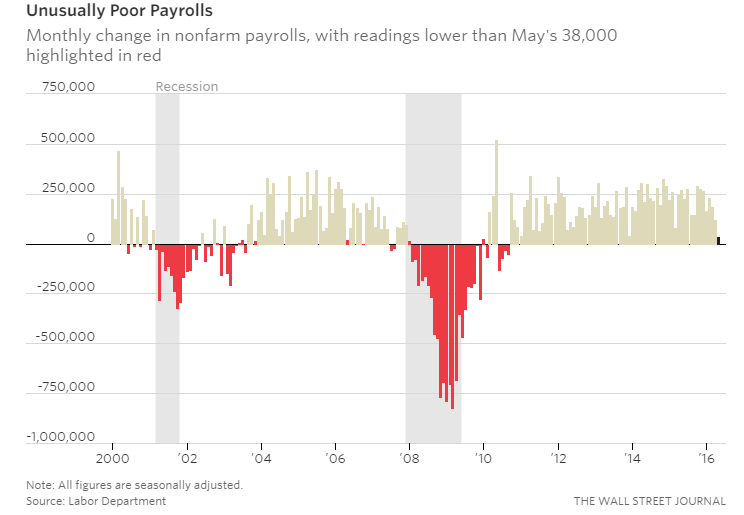

Non-farm payrolls report for May released last Friday showed US employment growth slowed sharply to 38k jobs in May which was weak even after adding back the 35k striking Verizon workers. Revisions to previous payroll data showed employers added a combined 59,000 fewer jobs in April and March than previously reported. That brought average monthly job growth in the past three months to 116,000, a sharp slowdown from the average growth of 219,000 over the prior 12 months. The unemployment rate, obtained from a separate survey of households, fell to 4.7% from 5% in April largely due to a steep decline in labor-force participation.

The softening in the pace of employment growth will make the Fed more cautious about resuming rate hikes in the near-term. Although the payrolls report is notoriously volatile, the slowdown in job growth in May will likely keep the Fed from raising rates for at least another month. May payrolls tally was depressed by a strike at Verizon Communications Inc. that temporarily idled 35,100 people during the Labor Department’s survey period. Those workers returned to work Wednesday and should lead to a rebound in the June jobs report.

Fed officials will be closely watching the next jobs report to determine whether May’s performance was an aberration. If the economic weakness if maintained or even intensifies in the coming months it will argue strongly against the Fed resuming rate hikes at all this year. June rate hike now appears off the table and the market is attaching just less than a one in three probability of a rate hike in July.

After rebounding solidly early in Q2 the US economy appears to have again lost upward momentum. The ISM manufacturing survey showed renewed weakness, while the non-manufacturing survey showed that business confidence declined more sharply than expected by 2.8 points to 52.9 in May, reaching its lowest level since February 2014. Data together resulted in the composite measure declining to just 52.7 in May which is more consistent with a weak economic growth of closer to an annual rate of 1.0%.

Markets now focus on a speech today from Fed Chair Yellen for an update on the outlook for Fed policy. In a previous speech, Fed Chair Yellen had stated that a rate increase would be appropriate “probably in the coming months” if the economy and labour market continue to strengthen. In light of the latest disappointing economic data releases Fed Chair Yellen is likely to strike a more dovish tone.

"Fed to remain on the sidelines and continue to look for more evidence before pushing rates higher. With the added uncertainty surrounding the Brexit vote, a June rate hike appears all but off the table for at least another month." said TD Economics in a report.

The dollar and bond yields weakened on Friday in the wake of the report’s release. The DXY fell 1.7% and the yield on the benchmark 10-year Treasury note fell to 1.702%, near its 2016 low. On Monday, the dollar staged a pullback on profit-taking. DXY was trading at 94.27 after hitting lows of 93.86 on Friday.

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says