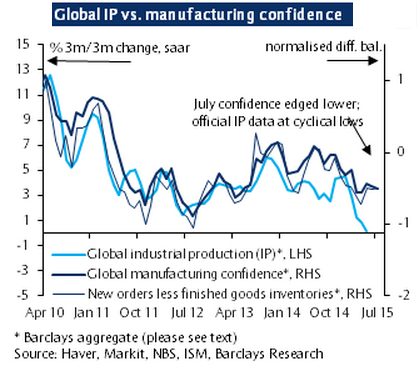

The final Barclays global manufacturing confidence index declined slightly in July, to -0.50 from -0.46, in line with the initial estimate for a decline, though less than expected as the disappointing demand growth in China was confirmed. While advanced economies continue to show resilient output and consumer demand (domestic new orders) in all three key regions the divergence from EM is growing; outside China, headline sentiment in EM Asia was still significantly below historic averages, and EEMEA manufacturing also softened, driven primarily by Russia. Global IP growth fell to the lowest level in six years in May, rising only 0.2% (on a 3m/3m basis, on a y/y basis, it was 2.35%, the lowest in 5.5 years). Global new orders less inventories actually improved slightly from June, to -0.49 from -0.51, suggesting that downside risks are more limited, at least for now.

In the US, the ISM manufacturing headline was slower than expected in July; however, the decline was driven mostly by less indicative components such as employment, supplier deliveries and new export orders, while the key indicators for the state of the domestic economy, the production and new orders components showed a solid expansion. Inventories also declined significantly, such that the gap between new orders and inventories improved to 7.0 (from 3.0 previously).

In Europe, the final July euro area manufacturing PMI was revised upward slightly (+0.2 points), to 52.4, vs. 52.5 in June, on stronger German activity and despite the plunge in Greek confidence. The main component drivers of the region's improvement were encouragingly focused on new orders and overall output, suggesting relative resilience to the Greek crisis as the gradual recovery remains intact. In terms of country breakdown, German and particularly Italian sentiment surprised on the upside, while French and Spanish indices were softer. In the UK, manufacturing confidence improved to 51.9 from 51.4, driven to a large extent by stronger manufacturing output, while new orders softened (driven by investment goods, while consumer goods orders improved). In addition, inventories increased notably, and the overall gap between new orders and inventories fell to 2.6 from 4.5 previously.

In Japan, the improvement in headline manufacturing sentiment was slightly softer than the flash estimate (rising to 51.2 from 50.1 in June, vs. an estimated rise to 51.4), but nevertheless showed a solid improvement in the pace of production, as well as domestic demand, albeit new export orders weakened. In addition, a strong rise in inventories pushed the new orders-inventories gap slightly lower, to 0.5 (from 0.6 in June, 1 point below long-term average).

In China, the headline NBS manufacturing fell to a five-month low, with weakness across the board; production was weaker than expectations, and declines in new orders and imports, as well as new export orders, showed continued slowing domestic and external demand growth, while inventories were slightly lower, suggesting some adjustment to lower production levels. The Markit series, though, suggests that inventories actually increased (and shows a sharper drop in new orders, new export orders and output). The combined measure of the two sources shows a decline in headline manufacturing confidence to the lowest level since March 2009 and a gap of new orders less inventories of just 0.1, down from 2.8 in June.

In the rest of EM, data were mixed, but mostly suggestive of soft manufacturing activity levels. LatAm countries were slightly improved, with Brazil headline manufacturing indicating a slightly moderating pace of contraction relative to June (47.2 vs. 46.5) and Mexico improving to 52.9 from 52.0. In EM Asia ex-China, India, Korea and Taiwan showed improved readings relative to June, though all are still hovering well below long-term averages and Korea and Taiwan are still pointing to a contraction in activity (below 50), while Singapore and Indonesia headline indices were lower than in June, both below 50. In EEMEA, the regional average was modestly lower, driven primarily by weak Russian sentiment (48.3 vs. 48.7 in June), as well as a strong slowdown in Hungary, while Turkey, the Czech Republic and Poland showed slight improvements.

July barclays global manufacturing confidence nearly flat on weak Chinese demand, while DM held up

Monday, August 3, 2015 9:43 PM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022