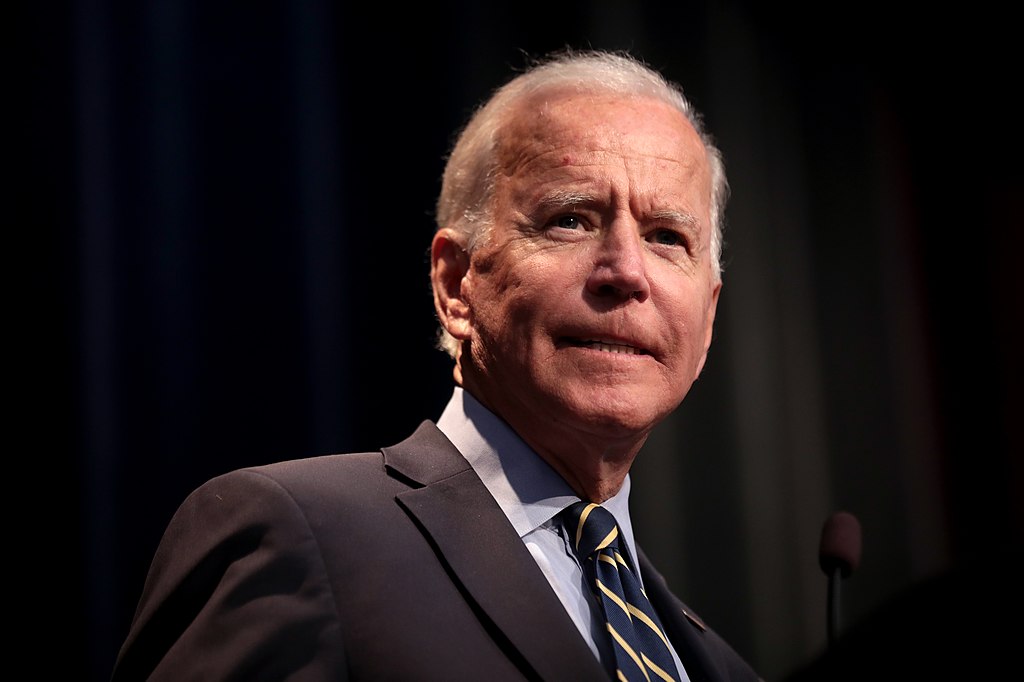

On May 14, President Joe Biden announced new tariffs on Chinese EVs, solar cells, and steel, intensifying U.S.-China trade tensions and taking a jab at Donald Trump.

Biden Criticizes Chinese Government Subsidies, Escalates Tariffs Amid Intensifying Trade Tensions with Trump

In a recent report by AP News, the Democratic president argued that Chinese government subsidies allow the country's businesses to avoid the need for profitability, giving them an unfair advantage in global trade. “American workers can outwork and outcompete anyone as long as the competition is fair,” Biden stated. “But for too long, it hasn’t been fair. For years, the Chinese government has poured state money into Chinese companies ... it’s not competition, it’s cheating.”

These sanctions come amid a heated campaign between Biden and his Republican predecessor, Donald Trump, to determine who is harsher on China. In a nod to the presidential campaign, Biden mentioned politicians and workers in Michigan, Pennsylvania, and Wisconsin, all battleground states in the November election.

When asked to respond to Trump's claims that China was undermining the U.S. economy, Biden retorted, "He's been feeding them a long time," and criticized Trump for failing to crack down on Chinese trade practices during his term. Trump campaign press secretary, Karoline Leavitt, called the increased tariffs a "weak and futile attempt" to divert attention from Biden's support for electric vehicles in the United States, which Trump claims will lead to layoffs at auto companies.

The Chinese government swiftly condemned the tariffs, stating they "will seriously affect the atmosphere of bilateral cooperation" and accused the U.S. of "bullying."

Due to their structure, the tariffs are not expected to have a broad inflationary impact in the immediate term, with some not going into effect until 2026. However, prices for EV batteries, solar products, and other specified commodities may rise in the meantime.

Biden administration officials believe the tariffs will not improve relations with China and anticipate that China will explore ways to counter the higher charges on its imports. The long-term impact on pricing remains uncertain, especially if tariffs lead to a broader trade conflict.

Tariffs on EVs, solar cells, syringes, needles, steel and aluminum, and other items will be phased in over the next three years, with the first taking effect in 2024. Currently, there are few Chinese electric vehicles in the United States, but officials are concerned that low-cost models made possible by Chinese government subsidies could soon flood the market. Chinese manufacturers can sell electric vehicles for as little as $12,000. China's solar cell manufacturers, along with steel and aluminum mills, have sufficient capacity to supply much of the world's demand, according to Chinese officials, who argue their output helps keep prices low and supports the transition to a green economy.

China's commerce ministry expressed "strong dissatisfaction" and threatened to "take resolute measures to defend its rights and interests," describing the tariffs as "typical political manipulation."

Trade Review Spurs Major Tariff Hikes on Chinese EVs, Solar Cells, and Steel, Raising Tensions

A four-year review of trade with China concluded that the tax rate on imported Chinese EVs would rise to 102.5% this year, up from 27.5%. This review was conducted under Section 301 of the Trade Act of 1974, which allows the government to retaliate against unfair trade practices. Under these rules, the duty rate on solar cell imports will double to 50% this year, tariffs on certain Chinese steel and aluminum products will increase to 25%, and computer chip tariffs are expected to rise to 50% by 2025. Tariffs on lithium-ion electric vehicle batteries will jump from 7.5% to 25% this year, with the same increase applying to non-EV batteries starting in 2026. There are also higher taxes on ship-to-shore cranes, vital minerals, and medical supplies.

Initially, these additional taxes are largely symbolic, affecting around $18 billion in imported goods. According to a recent Oxford Economics analysis, tariffs will have a minor impact on inflation, raising it by 0.01%. BYD, a Chinese EV manufacturer, is considering building plants in Mexico for the Mexican market, potentially providing a means to send goods into the U.S. U.S. Trade Representative Katherine Tai said she was discussing this possibility with business and labor groups and encouraged them to "stay tuned."

The car industry is currently assessing the impact of the tariffs, which appear to only affect two Chinese-made vehicles: the Polestar 2 luxury EV and possibly Volvo's S90 luxury gas-electric hybrid midsize sedan. “We’re still reviewing the tariffs to understand exactly what’s affected and how,” said Russell Datz, spokesman for Volvo, a Swedish brand now under China’s Geely group. A message was left seeking comment from Polestar, which also falls under Geely.

Wang Wenbin, a spokesperson for China's foreign ministry, claimed that the United States is violating market economy principles as well as international economic and trade rules. “It’s a naked act of bullying,” Wang said.

The Chinese economy has been hampered by the collapse of the country's real estate market and previous coronavirus pandemic lockdowns, causing Chinese President Xi Jinping to try to revive growth by increasing the production of EVs and other items, producing more than the Chinese market can consume. This plan heightens tensions with the U.S. government, which argues it is eager to boost its own industry to compete with China while avoiding a broader conflict.

“China’s factory-led recovery and weak consumption growth, which are translating into excess capacity and an aggressive search for foreign markets, in tandem with the looming U.S. election season add up to a perfect recipe for escalating U.S. trade frictions with China,’’ said Eswar Prasad, professor of trade policy at Cornell University.

EU Investigates Chinese Subsidies as Biden Administration Criticizes China's Bid for Global Manufacturing Dominance

The European Union shares these concerns. Last November, the EU initiated a probe into Chinese subsidies and may levy an import tax on Chinese EVs. Following Xi's visit to France last week, European Commission President Ursula von der Leyen warned that government-subsidized Chinese electric vehicles and steel "are flooding the European market" and that "the world cannot absorb China's surplus production."

Biden's administration regards China's manufacturing subsidies as an attempt to gain global control of the EV and clean-energy sectors, but the government claims that its own industrial support is aimed at securing domestic supply to help fulfill U.S. demand. “We do not seek to have global domination of manufacturing in these sectors, but we believe because these are strategic industries and for the sake of resilience of our supply chains, that we want to make sure that we have healthy and active firms,” Treasury Secretary Janet Yellen said.

The tensions extend far beyond a trade conflict to more fundamental questions about who leads the global economy. China's policies have the potential to increase the world's reliance on its manufacturing, giving it greater geopolitical leverage. At the same time, the United States argues it wants countries to adhere to the same rules so that competition is fair.

China contends that the duties violate global trade standards established by the United States through the World Trade Organization. It criticizes the United States for politicizing trade issues and argues that the additional penalties exacerbate problems caused by previous duties imposed by the Trump administration, which Biden has maintained.

These issues are central to the upcoming presidential election, with a deeply divided electorate seemingly unified by the idea of toughening relations with China. Biden and Trump have overlapping but distinct strategies. Biden believes targeted tariffs are necessary to protect critical industries and workers, whereas Trump has threatened 10% tariffs on all imports from rivals and allies alike.

Biden has staked his presidential legacy on the United States outpacing China with its own government investments in factories producing EVs, computer chips, and other innovative technologies. Trump warns his supporters that America is falling further behind China by not relying on oil to fuel the economy, despite climate change threats. While Trump believes tariffs can influence Chinese behavior, he also asserts that the United States will continue to rely on China for EV components and solar cells.

“Joe Biden’s economic plan is to make China rich and America poor,” Trump declared at a rally in Wisconsin.

Photo: Gage Skidmore from Peoria, AZ, United States of America, CC BY-SA 2.0, via Wikimedia Commons

AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock

AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Google Cloud and Liberty Global Forge Strategic AI Partnership to Transform European Telecom Services

Google Cloud and Liberty Global Forge Strategic AI Partnership to Transform European Telecom Services  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence

Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence  SpaceX Pivots Toward Moon City as Musk Reframes Long-Term Space Vision

SpaceX Pivots Toward Moon City as Musk Reframes Long-Term Space Vision  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  SpaceX Seeks FCC Approval for Massive Solar-Powered Satellite Network to Support AI Data Centers

SpaceX Seeks FCC Approval for Massive Solar-Powered Satellite Network to Support AI Data Centers  Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate

Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies

Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies