Bank of Japan (BOJ) policymakers' are you taking note for the next meeting on October 30th. Policy by the bank is struggling to put an end to deflation, in spite of its massive easing.

Economic dockets are continuously pointing at further weakness in Japan's economy and trade as well as inflation outlook but BOJ policymakers including Governor Haruhiko Kuroda stressed that Japanese underlying momentum for growth and inflation is strong and it is the oil price that is to be blamed.

Isn't the credibility of the bank is at stake here - Most of the economists believe iron will from the central bank is needed to reign on deflation that has remained in place for almost two decades.

Initially when the qualitative and quantitative easing (QQE) program was launched, BOJ showed iron determination and confidence to reign over deflation, however as time passed the bank even dropped its two year time line to achieve inflation.

And now the bank waiting for the Dollar, to weaken Yen further and oil price recovery to return of inflation.

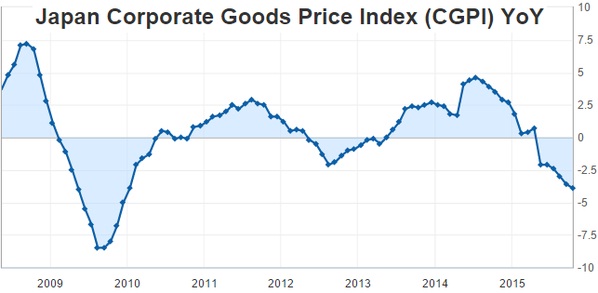

Latest data of Producer price shows the economy may not be heading towards intended direction.

- Domestic corporate goods price index decline by -0.5% in September, which is down by -3.9% from a year ago, a level of decline not witnessed since the 2008/09 crisis.

Yen is currently trading at 119.5 per USD.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary