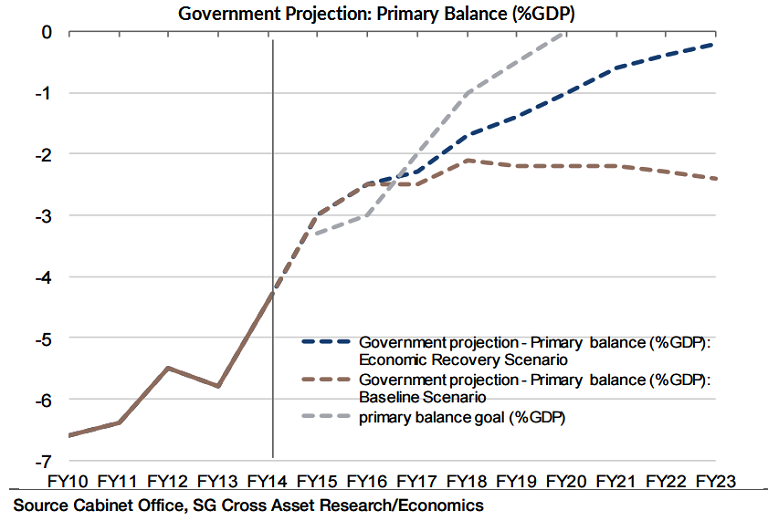

Japan's 2015 fiscal plan is different from the previous fiscal plan in which improving the primary balance to a surplus was the main objective. The key principle underlying in the new Japan's Economic and Fiscal plan 2015 is "There is no fiscal soundness without economic recovery". The primary objective now is to exit deflation as soon as possible, while achieving a primary balance surplus is only secondary.

In the previous fiscal plan in order to achieve a primary balance surplus by FY2020, a large fiscal austerity plan or an increase in taxes was necessary. The government expected that once the fiscal austerity plan as well as tax hike are promoted, fiscal stability can be expected, and this should reduce anxiety in the future. However, the outcome was different: this "relief effect" did not work. On the contrary, households' financial burden increased due to the consumption tax hike in April 2014 and consumption weakened.

In fact, according to the latest "Comprehensive Survey of Living Conditions" survey by the Ministry of Health, Labour and Welfare, the percentage of households feeling difficulty in living increased to 62.4%, the highest level since the survey started in 1986.

Against this backdrop, the government has in the new fiscal plan set up a soft fiscal guideline which is in line with achieving economic growth. Strong GDP growth rate being the main objective in the new fiscal plan, the GDP growth rate target of of 2% real GDP growth and 3% nominal GDP growth is definitely not an underlying assumption.

This time, an exit from deflation is highly expected in the foreseeable future, and there are clear developments regarding economic recovery. In addition, it is also highly likely that reducing the primary balance (as of % of GDP) to half of the level seen in 2010 is achievable.

Critical inflation figures from Japan are also due tomorrow. USD/JPY is extending yesterday's upbeat momentum, currently trading at 124.36, looking to consolidate the recent break above the 124.00 handle.

Japan's new fiscal plan signals possiblity of complete exit from deflation

Thursday, July 30, 2015 11:28 AM UTC

Editor's Picks

- Market Data

Most Popular

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient