Japanese 40 year bond prices slipped on Thursday, sending long-term debt to almost two weeks low, after the central bank reduced the size of a buying operation. The BoJ bought fewer than expected longer bonds in its purchase operations and the central bank reduced its purchase amounts in JGBs maturing in 10- to 25-years, and in 25- to 40-years, by 200 billion yen ($1.77 billion) in each zone.

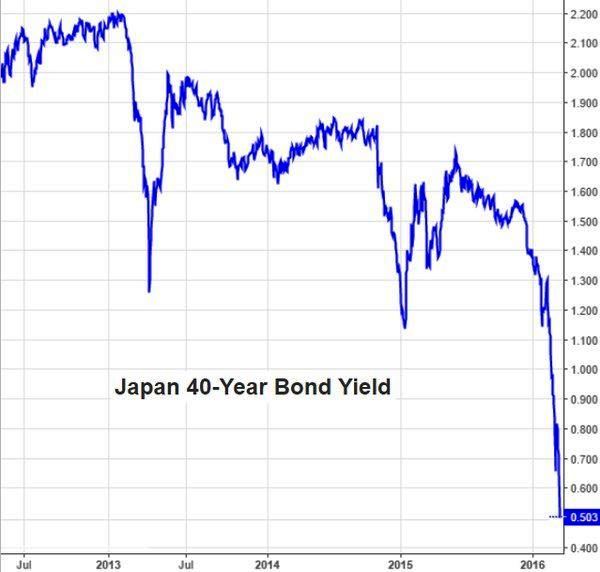

The 40-year yields were trading lower -1.73% at 8:46 AM London time. Meanwhile, benchmark 10-year yields were little changed at negative 0.09%.

According to recent news, Japan's Ministry of Finance has floated a plan to reduce the issuance of inflation-linked Japanese government bonds (JGB) at its next auction schedule for April 12 to 400 billion yen from an originally planned 500 billion yen.

Moreover, the price of the inflation linked JGBs has faced continuous pressure from global economic slowdown and weak crude oil prices, which prompted investors to lower their inflation expectations.

“Because of reduced issuance of some maturities from April, they expect a reduction in the BOJ’s buying,” said Tomohisa Fujiki, the chief rate strategist at BNP Paribas SA in Tokyo.

In addition, we foresee that if GDP growth and inflation fail to improve over the coming months, another cut will probably occur sooner rather than later. We also believe that in the April meeting of the Monetary Policy Board pressure, will mount on the BoJ to take action as political pressure for additional monetary stimulus may intensify ahead of nationwide elections in July, making JGB less attractive asset for investment.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed