Latest PMI report from Markit economic reveals continued weakness in Japan's economy, which poses question over Abenomics' as well as bank of Japan's (BOJ) ability to revive the economy from decade old deflation.

- While Japanese exporters have surely benefitted from weaker Yen, boosting the appeal for their products around the world, consumers have severely cut back on spending with signs of higher price.

- After years of deflation consumers have gotten used to lower prices and signs are plenty that they are having difficult time adjusting to higher prices, partly driven by weaker Yen and rest by sales tax hike to 8% from previous 5%.

- Japanese government had to postpone, scheduled for this year, another sales tax hike thanks to weaker economy and lower consumer spending.

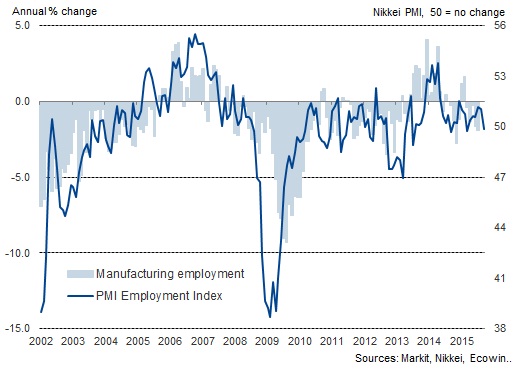

Today's flash PMI report showed that Japan's manufacturing headline reading is to slow to 50.9 in September from 51.7 in August.

Moreover as shown in chart, employment at factory level dropped for the first time in six months, which clearly suggests that manufacturers are not too upbeat on Japan as well as global economy. However that is not likely to affect overall unemployment level, which stands around 3.3%, one of the lowest in the world.

Japanese Nikkei is down -0.5% today, while yen is up 0.22% against Dollar, trading at 120.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?