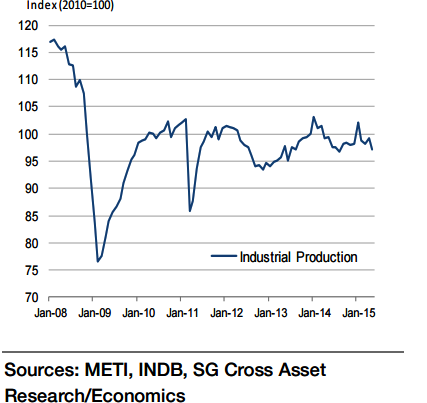

Japan's overseas demand remains unstable, and many companies are unwilling to invest in inventories. June industrial production is likely to show modest growth of 0.1% mom.

In July's monthly economic report, the government revised down its overall assessment on production to "production remains flat". As producers have been cautious regarding inventory investment in the past, the level of inventories is not a major problem. Therefore, production is not expected to tumble.

According to Societe Generale,

Japan's June industrial production likely to show modest growth

Monday, July 27, 2015 6:38 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed