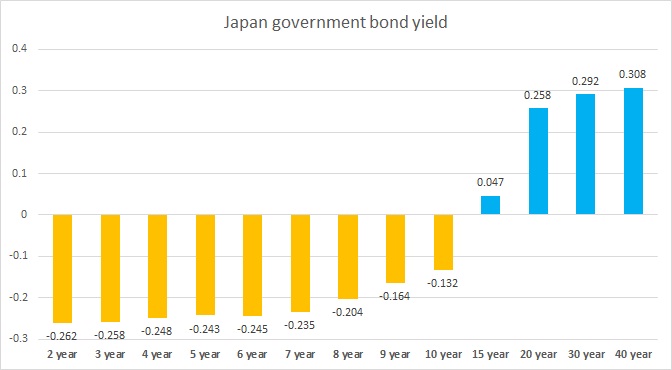

Hunt for yield and place to park money in the wake of negative rates from Bank of Japan (BOJ) has now shifted the yield curve to new record low. While global bonds are in retreat in the wake of risk affinity, which pushed global equities to highest since December. But it is having no effect in Japanese government bonds market. Price reached to new record highs across the curve as yields dropped to record low.

Since January, 40 year JGB yield has fallen 120 basis points and now trading around 0.3%. Similarly 10 year JGB yield has fallen 58 basis points and now trading in negative at -0.135%.

If inflation is approaching it is hardly making sense to lend to Japan, which has debt ratio of more than 200% of GDP, for 40 years at 0.3% and for 10 year at negative. Nevertheless market seems to be fine with that.

So naturally a question keeps lingering is market pricing a deflationary environment in Japan. Bank of Japan’s (BOJ) asset purchase program is surely contributing to the phenomenon at large, but massive savings glut is also behind the move.

In the wake of negative rates, Japanese investors have been purchasing debt securities outside the country. Since February Japanese investors have purchased $65 billion worth of foreign debt.