Recession and deflation, do not seem to be ready to leave Japanese economy, posing doubts over Abenomics 2, named after Japanese Prime Minister Shinzo Abe. Mr. Abe, in his stage two of Abenomics program has set a goal to raise Japan's GDP by 20% to ¥ 600 trillion by 2020. However, that target is seriously in doubt, along with bank of Japan's (BOJ) 2% inflation target as Japan is back on the verge of deflation.

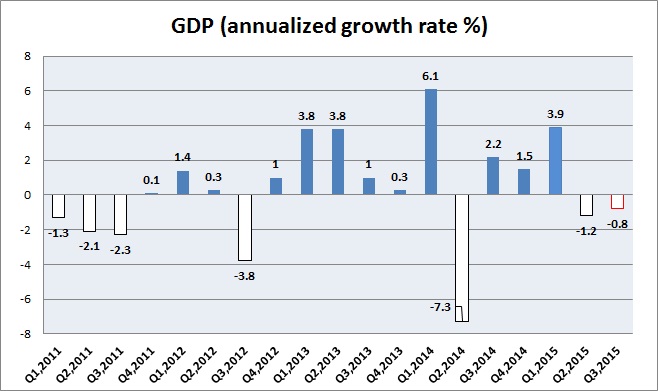

- Latest flash reading showed, Japanese economy shrank by 0.2% in third quarter or 0.8% annualized pace after shrinking -0.3% in the second quarter.

Though, Bank of Japan, indicated that at current point further easing may not be necessary, without any further risks from emerging markets or China but calls are going strong from economists and analysts for BOJ to do more to fight back current slowdown in economic activity and weaker inflation.

However, with BOJ purchasing at pace of ¥ 800 trillion per annum, it is likely to own close to 90% of outstanding Japanese bonds by 2019 and any further increase in pace of purchase will only bring that time line closer. Moreover, as Japan imports almost all of its energy need could face worsening current account should energy price rise, thanks to weaker Yen.

Yen's devaluation since 2012, might lose its charm if European Central Bank (ECB), choose to expand its stimulus program leading to much weaker Euro.

Yen is currently at 122.5 per Dollar, trading strong over risk aversion.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand