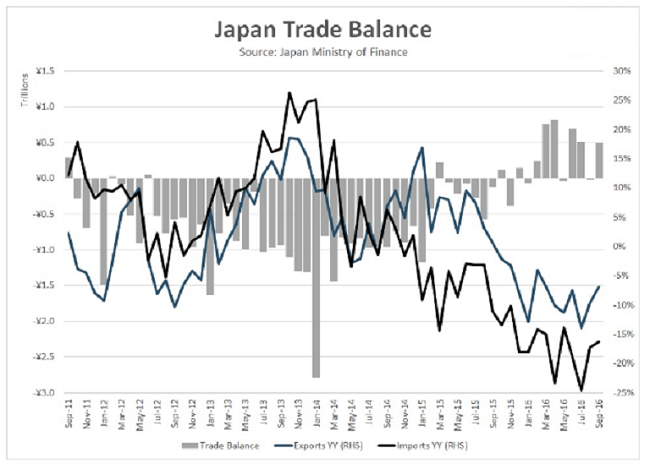

Trade balance in Japan posted a surplus during the month of September, with exports declining for the 12th consecutive month albeit at a much slower rate than expected.

Japan’s merchandise trade surplus rose to JPY498.3 billion in September following a deficit of JPY18.7 billion in August. A median estimate of economists called for a surplus of JPY341.8 billion, data released by the Ministry of Finance (MoF) showed Monday.

Japan’s exports declined 6.9 percent in the 12 months through September, following August’s 9.6 percent drop. A median estimate of economists called for a decline of 10.4 percent. Imports plunged at an annualized 16.3 percent; they fell 17.3 percent year-over-year in August.

Further, in seasonally adjusted terms, Japan’s surplus widened to JPY349 billion in September, official data showed. Also, the MoF reported that the value of exports to the US fell by 8.7 percent over the year, mirroring a similar decline in exports to Asia which slid by 8.4 percent.

The value of exports to China, Japan’s largest trade partner fell by a larger 10.6 percent, while those to the European Union rose by 0.3 percent.

Meanwhile, later this week, the Japanese government will release fresh inflation data for the months of September and October. Separate government reports will also unveil the latest employment and household spending figures.

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns